Percentage of residents reporting income loss;

Credit: STATEC ad-hoc survey "COVID-19" 2020

Percentage of residents reporting income loss;

Credit: STATEC ad-hoc survey "COVID-19" 2020

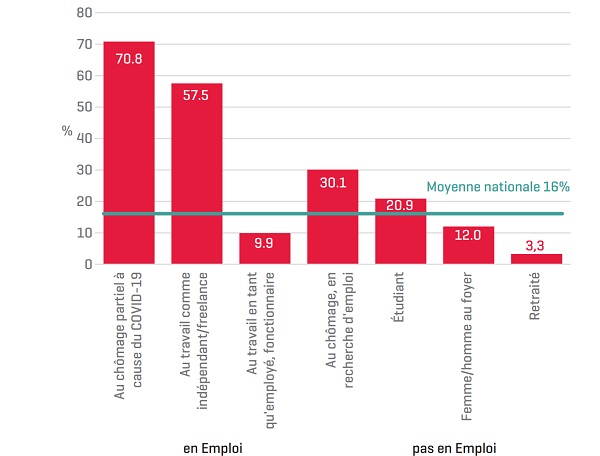

In its latest report, STATEC revealed that 16% of Luxembourg residents experienced a decline in income during confinement; the unemployed and students were especially affected.

Whilst 82% of residents have not experienced a deterioration in their income, 16% reported a loss of income whilst 2% said their income had increased. Among the employed, 77% reported no income drop, 21% reported a limited loss and 2% saw an increase. People who are partially unemployed due to COVID-19, the self-employed and employees in the private sector were the most affected by a decrease in income.

Among those who are not working, a significant proportion of the unemployed have experienced a loss of income, as have students. This loss of income is linked to the sector of activity: 56% of those concerned concerned work in the hospitality (Horeca) sector, 43% in commerce, 42% in industry and 39% in construction. The main reasons for this income loss were, in order of importance: the involuntary reduction of working hours, the loss of employment or involuntary cessation of activity with a resulting decrease in wages for the employees or in profit for independent workers.

Young people aged 18-24 and those aged 45-54 were the most affected by the economic consequences of the pandemic. For young people, a loss of income stemmed from the loss of employment, whilst for 45-54 year olds, this resulted from a drop in salary or profit (for the self-employed). According to STATEC, women aged 18-24 have been paying a heavy price for the pandemic; they are more likely to suffer a drop in income, all categories combined.

Income loss also depended on the level of education. People with lower secondary level education were twice as likely as those with a master's or higher qualification to experience this decline.

During confinement, about 58% of residents spent less and 16% spent more money. About 26% saw no change in spending. However, there are disparities. During confinement, modest households, which have most experienced a drop in income, reduced their consumption because they had more necessary expenses. One in five people whose income has gone down has seen an increase in spending. These people therefore face financial difficulties related to COVID-19. In general, however, the confinement resulted in a drop in consumption: 39% of households were left with a higher disposable income than before the health crisis.

Among the respondents, 62% lived in a house and 38% in an apartment. 10% lived in accommodation that has no outdoor space. Among those who have such access, 73% have a garden or land, 58% a terrace or balcony and 11% a courtyard. Loneliness was a subject raised often during confinement, with almost 17% of people confined alone, of which 29% were at least 65 years old.

The report concluded that respondents whose housing conditions were least favourable were also those who have experienced the most financial difficulties (drop in income and increase in expenses).