Credit: BCL, STATEC

Credit: BCL, STATEC

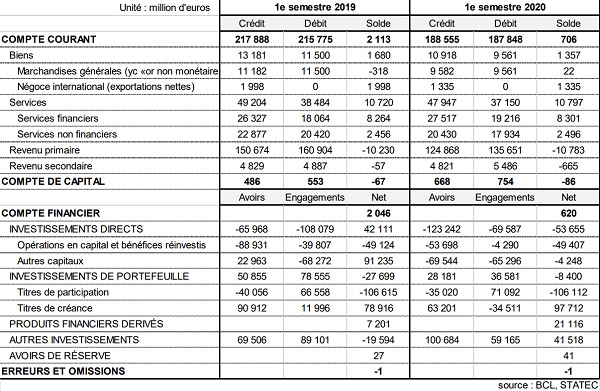

Luxembourg's balance of payments for the first half of 2020 amounted to €706 million, according to STATEC and the Banque centrale du Luxembourg (BCL).

The current account balance for the first half of the year stood at €706 million, down €1.4 billion compared to the same period in 2019. Both the balance of goods and that of primary and secondary income fell.

In terms of goods, imports and exports fell by around 17% in the first half of 2020. This decline affected all types of products, with the low point recorded in April. A similar decrease in secondary income was attributed in part to an increase in social contributions (eg partial unemployment, family leave, etc.) paid to cross-border workers during lockdown.

The situation differed for international trade in services. Financial services performed relatively well, with an increase of 6.4% and 4.5% for imports and exports respectively (compared to the first half of 2019). According to STATEC and the BCL, the financial sector has been less impacted by the health crisis than the rest of the economy. After two consecutive months of decline in February and March, the net assets under management of investment funds (which have the most significant impact on financial services) have since returned to growth (up 4% in the first half of 2020 ).

On the other hand, non-financial services suffered a significant decline for both imports (down 12.2%) and exports (down 10.7%). The services most affected by this development were travel services (including the collapse of business travel), other business services and personal, cultural and recreational services.

In the financial account, in the first half of 2020, direct investment flows continued to be characterised by divestment operations for both assets (down €123 billion) and commitments (down €69 billion). These operations concerned a few SOPARFIs, which continued their operations to restructure, terminate or relocate their activities.

Regarding portfolio investments, the second quarter of 2020 was characterised by the resumption of investments in Luxembourg equities (mostly UCI units), after the net sales observed in the first quarter of the year, in a context of falling stock prices following the COVID-19 pandemic. Transactions in Luxembourg equities thus ended up with net inflows of €71 billion in the first half of 2020.

Luxembourg debt securities, on the other hand, suffered net sales of €34 billion in the first half of the year. Luxembourg residents continued to shy away from foreign equity securities whose transactions resulted in net sales of €35 billion in the first half of 2020. Foreign debt securities suffered net purchases of up to €63 billion over the same period.