Credit: MFIN

Credit: MFIN

On Friday, Luxembourg's Minister of Finance, Pierre Gramegna, presented the financial situation of the state as of 30 September 2019, at the joint meeting of the Finance and Budget Committee and the Budget Execution Control Commission.

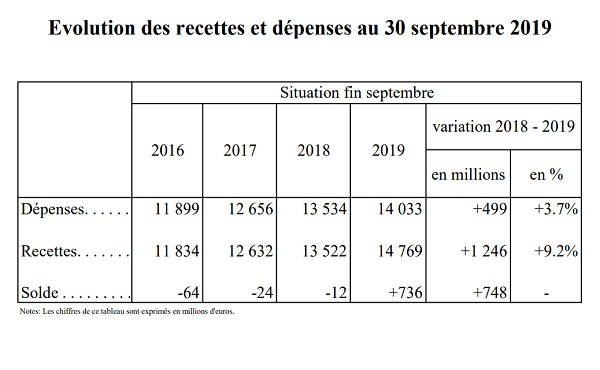

In accordance with the ESA 2010 rules, the Central Government recorded a surplus of €736 million. This positive situation can be explained, on the one hand, by the favourable evolution of receipts, notably the community income tax and value-added tax (VAT), and on the other hand, by the expenditures which are still stagnating due to the phenomenon of provisional twelfths in the first four months of the year. Revenues thus increased by 9.2% and expenditures only increased by 3.7% compared to September 2018.

The downward trend in diesel sales following the two-cent increase in excise duty in May 2019 was also confirmed at the end of September 2019. Sales between May and September 2019 thus decreased by 0.31% compared to the same period in 2018. The government continues to monitor developments in this area closely.

At the state budget execution level, according to the state accounting rules, the revenue execution rate was 77.7%, ie 2.7% higher than the execution to be achieved in September. At the level of expenditure, the implementation rate was 75.3%, which corresponds to expectations overall. While the voted budget provides for a deficit of €815.2 million for the 2019 financial year, the government's accounts showed a balance of - €222.6 million on 30 September 2019. On the basis of this evolution, it is estimated that the balance for the year 2019 will improve significantly compared to the voted budget.

Pierre Gramegna commented: "The Government is pleased with the positive scissor effect of revenue and expenditure. Revenues are higher than budget and spending is in line with expectations. Given this favourable trend, the Ministry of Finance is confident that by the end of 2019, Central Government will be in a much better position than expected".