Stock market indices;

Credit: Macrobond

Stock market indices;

Credit: Macrobond

STATEC has published a report highlighting the potential indirect effects of recent US trade policy decisions, particularly tariff increases, on the global economic outlook and Luxembourg’s export-driven sectors.

According to the report, the decisions taken by the new US government, particularly regarding the increase in customs tariffs, have heightened uncertainties surrounding global economic prospects. While Luxembourg’s exposure in terms of exports of goods to the United States is relatively limited, indirect effects resulting from a deterioration in the global economic climate cannot be excluded.

Since President Donald Trump took office on 20 January 2025, his administration has made numerous reform announcements, some of which have already been implemented. As reported by STATEC, economically, the main change concerns the increase in US customs duties (tariffs), primarily targeting China and its North American neighbours (Canada and Mexico), but also Europe and other regions. Certain products, notably steel and aluminium, have been subject to broad-based tariff increases. The stated objective is to reduce the United States’ trade deficit, protect its economy from what is deemed unfair competition and encourage companies to increase domestic production. However, such protectionist measures typically provoke retaliatory actions of a similar nature from the affected countries.

As noted by STATEC, in terms of trade in goods, the United States has accounted for approximately 3% of Luxembourg’s exports in recent years, with a similar proportion for imports. This share is higher (around 6-7%) for metals and metal products, which represent 30-40% of all goods exported to the US, as well as for textile industry products, which make up roughly 10% of exports to the US. Regarding services, the US represents around 4-5% of Luxembourg’s total service exports, with nearly equal proportions for financial and non-financial services.

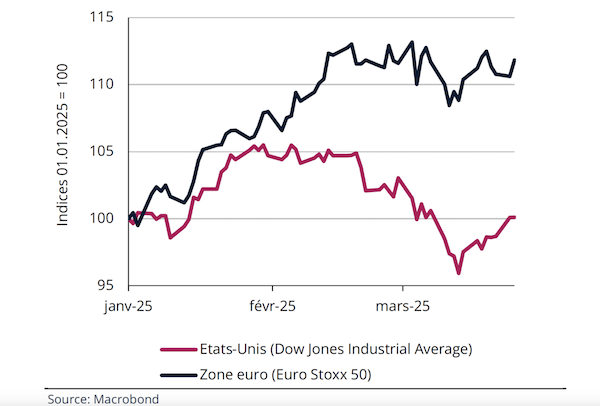

Despite this relatively limited direct exposure, Luxembourg could be affected by negative indirect effects resulting from reduced US demand for European partners. For example, US trade policy has specifically targeted German car exports, and Germany is Luxembourg’s main trading partner. There is also potential risk of contagion via financial markets.

The STATEC report also looked at GDP growth in the Grand Duchy. In the fourth quarter of 2024, Luxembourg’s real GDP increased by 1.4% compared to the previous quarter. This growth was primarily driven by positive performance in the financial sector, industry and non-market services. In contrast, market services - except for the hospitality sector - recorded a decline, particularly in the trade and ICT branches, whose developments in the third quarter were also revised downward. Overall, 2024 closed with a GDP increase of 1.0%, compared to +0.5% projected in STATEC’s December forecast.

The annual national accounts have also undergone revisions. While the contraction in real GDP for 2023 is now estimated at -0.7% (less severe than the previous estimate of -1.1%), the figure for 2022 has been revised downward to -1.1% (from a previously reported +1.4%). This revision for 2022 mainly stems from weaker results in the construction sector - particularly real estate development - and in wholesale trade. Real GDP figures for the years 2018 to 2021 have also been revised, albeit marginally.

Looking at the financial sector, STATEC noted that the net assets of European investment funds rose by 13% (+10% in Luxembourg) in 2024, driven by growth in equity prices and an upturn in net issues, particularly in the fourth quarter. Ireland gained further market share in funds.

Concerning mortgages, the rise in lending for residential property in Luxembourg, which began in spring 2024, accelerated in the fourth quarter of 2024 (+37% year-on-year, following on from +25% and +9%). STATEC largely attributed this increase to the growth in approved. Banks have also reported a rise in mortgage applications, which they said has been helped by an improved outlook for the real estate market and increased consumer confidence.

Inflation in Luxembourg has remained moderate. In February 2025, inflation stood at 1.7%, after 1.9% in January 2025 and 1.0% in December 2024. Services continued to make the biggest contribution to price rises in the Grand Duchy, although this contribution tends to fall (+0.9 percentage points in February, after peaking at 2.1 percentage points a year ago). Since the partial lifting of the price cap on 1 January 2025, energy has once again made a positive contribution to inflation (+0.5 percentage points on average over the first two months of the year, with 0.4 percentage points from electricity). The prices of food and non-energy industrial goods, which had risen sharply in 2022 and 2023 due to the sharp rise in energy prices, have had almost no impact on inflation at the start of 2025 (each contributing +0.2 points).

In the eurozone, inflation remained restrained at 2.3% in February. However, tensions are slightly higher than in Luxembourg for services and food prices, noted STATEC. Energy prices have hardly contributed to inflation in the eurozone, as most price caps ended more than a year ago.

STATEC also noted that the rise in unemployment has eased significantly in recent quarters, with the rate stabilising at about 5.9% since November 2024. The unemployment rate in the eurozone has continued to fall, reaching 6.2% of the labour force in January 2025.

Moreover, the report addressed renewable energy in Luxembourg, which experienced contrasting trends in 2024. After a modest increase in photovoltaic production in 2023 (+9%), it surged in 2024 (+63%), overtaking wind generation for the first time. STATEC said this growth was due partly to a record expansion in capacity, with the number of installations rising from 14,000 to almost 23,000, as well as more favourable weather conditions, with a 7% increase in the number of hours of sunshine compared with 2023.

Conversely, wind generation slowed. After a sharp increase in 2023 (+44%), it fell slightly in 2024 (-4%). This fall is explained by a relative stability in capacity (+3%) and a reduction in average wind speed (-10%). However, with future wind farm projects already authorised, capacity growth is expected to increase once more. Electricity generation using renewable fuels recovered in 2024 (35%) after a sharp fall in 2023 (-43%), mainly due to the production of electricity from scrap wood.

IK