Credit: Eurostat via STATEC

Credit: Eurostat via STATEC

On Monday 26 August 2024, STATEC published a report about the economic recovery in Luxembourg and the eurozone.

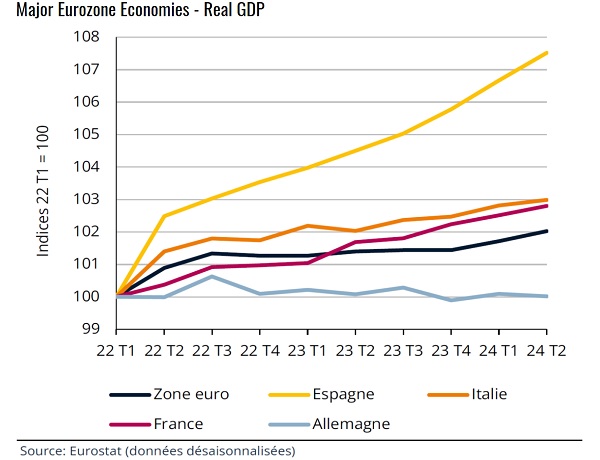

STATEC reported that GDP growth in the eurozone in the second quarter of 2024 confirmed the recovery observed in the previous quarter (+0.3% over one quarter). However, more negative signals emerged at the start of the summer (including in Luxembourg), suggesting a less favourable climate than expected.

Business surveys show signs of slowdown

STATEC also warned that the strengthening of activity observed in the first part of 2024 may not last: the results of business surveys have been deteriorating recently. The eurozone economic climate indicator showed that confidence indicators declined "significantly" in Luxembourg in July 2024 for industry (the lowest in seven months), retail trade (also the lowest in seven months) and other non-financial services (the lowest in ten months), whereas they had recovered in the first half of the year.

In construction, on the other hand, Luxembourg entrepreneurs have been slightly more optimistic in recent months, although confidence remained below the long-term average.

International economic uncertainty

In addition to geopolitical tensions, STATEC noted that the international context remains marked by economic uncertainty in the world's leading economic powers: the United States and China.

Activity - Air transport trends

The STATEC report noted that air transport in Luxembourg had returned to pre-pandemic levels in 2022 and exceeded these levels in 2023 (+10% compared to 2019) - unlike in neighbouring countries such as Germany (-18%), Belgium (-9%) and France (-5%). Despite a drop between the end of 2023 and the start of 2024, the number of passengers recorded in Luxembourg resumed its upward trajectory (+8% over one year in the first seven months of 2024). This number is expected to exceed the five million mark this year, thus doubling over ten years.

In the freight sector, Luxembourg benefited from a relatively high level of activity during the pandemic (particularly compared to France and Germany), but declined significantly in 2022 and more or less stabilised in 2023. At the beginning of 2024, air freight witnessed a slightly upward trend and recorded an increase of about 3% compared to the previous year (over the first seven months).

Consumption - Car registrations

The report also showed that passenger car sales increased by 4% year-on-year in the eurozone in the first half of 2024. The results are mixed depending on the country, with sales proving to be particularly dynamic (compared to last year) in Germany, Austria and Southern European countries, but declining in the Netherlands, Belgium, Finland and Luxembourg (where they were down by about 5% compared to the first half of 2023).

As for commercial vehicles, Luxembourg registrations also fell behind the European trend in the first half of the year: -30% over one year for vans (compared to +15% in the EU) and -40% for trucks (+3% in the EU). Only bus registrations escaped this trend: +42% in Luxembourg compared to +30% in the EU.

Real estate - mortgages recovering

According to the survey on the distribution of bank credit, mortgage applications in Luxembourg have increased over the last two quarters, after almost three years of decline. At the same time, the share of rejected applications has been decreasing. In the eurozone, banks are also reporting a recovery in applications and, as in the Grand Duchy, they expect this trend to continue in the third quarter.

The number of loans granted for residential properties in Luxembourg increased by 9% year-on-year in the second quarter. STATEC attributed this increase to mortgages for non-developers, which have increased significantly, while loans granted to developers fell in the first half of 2024. Seasonally adjusted data showed that the low point in real estate loans granted to non-developers was reached in the fourth quarter of 2023 and that they have been rising since then. This echoes the turnaround observed for real estate transactions over the same period, added STATEC.

Financial environment - Stock market

Stock markets experienced high volatility with massive sales following the monetary policy meetings of the US Federal Reserve and the Bank of Japan on 31 July 2024. Three days later, the Japanese stock index fell by 20% while the US and European benchmark indices lost 6%. The VIX Index reached a peak not seen since the health crisis.

STATEC later added that valuations are rising in all regions and in all sectors, supported in particular by the growth of corporate profits.

Inflation - Tobacco

STATEC reported that tobacco is becoming more expensive, especially in neighbouring countries: +38% in the Netherlands over one year in July, +22% in Belgium, +13% in Latvia and +9.5% in Luxembourg. This development is mainly explained by an increase in tobacco taxes in these countries. The price of a packet of cigarettes remained significantly higher in France and Belgium (about €12 for a classic packet of 20 cigarettes, compared to €9 in the Netherlands and €8 in Germany), while prices remained comparatively low in Luxembourg (€6).

Labour market - Cross-border employment

The report noted that employment growth continued for French cross-border workers and Luxembourg residents albeit at a slower pace. The number of German and Belgian cross-border workers declined by -0.5% and -0.2% respectively between the end of 2023 and May 2024. Last year, the extent of the slowdown for cross-border workers (+2.2% after +4.0% in 2022) was more marked than that observed for residents (+1.7% after +2.6%), with cross-border employment reacting more strongly to economic fluctuations.

However, the relative attractiveness of Luxembourg also depends on working conditions, said STATEC. The growth of French cross-border workers remained slightly below its average of the last decade in 2023 (at +3.2%), while the growth rate for German and Belgian workers more than halved (to just over 1%). Cross-border workers remained slightly dominant in new jobs created last year (51%).

Preliminary data available up to July indicated a possible recovery in cross-border employment, although the trend was less clear for residents.

Energy - Less volatile oil and gas prices

Compared to the energy crisis in 2022, oil and gas prices have been relatively stable since mid-2023, despite persistent geopolitical tensions in Ukraine and the Middle East, noted STATEC.

The gas price did not exceed the 40EUR/MWh mark in 2024 and seemed less influenced by events in Russia and Ukraine. STATEC noted that the EU significantly has reduced its consumption - by 14% in 2022 and 8% in 2023 - and diversified its gas supply sources. Consequently, Europe was able to reduce its imports of Russian gas by more than 70% compared to 2021. With a filling level of almost 90%, stocks are "well supplied" as autumn approaches.