Credit: Statec

Credit: Statec

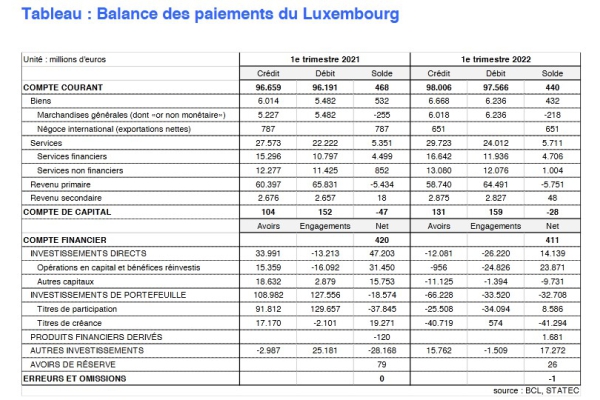

The Banque Centrale du Luxembourg (BCL) and Luxembourg's national statistics agency, Statec, has announced that, according to initial provisional results, the state's current account ended with a surplus of €440 million in the first half of 2022, i.e. a decrease of €28 million compared to the same period in 2021.

Luxembourg's trade surplus stood at €432 million, having declined slightly in the first half of 2021 (down €100 million). Nevertheless, exports and imports rose by around 11% and 14% respectively. Net exports from international trade went down 17% (down €312 million). General merchandise exports (excluding trade) amounted to 15% (up €790 million), while imports increased by 14% (up €754 billion).

The balance of international trade in services increased by 7% in the first half of 2022 (up €360 million), which is attributed to the fact that exports and imports grew at a sustained pace, by 8% respectively. International trade in non-financial services grew slightly for exports (up 7%) and imports (up 6%), whilst trade in financial services posted strong growth of 9% for exports and 11% for imports. This development is mainly explained by the significant appreciation in average assets managed by investment funds during the period under review (up 6%).

In the financial account, during the first half of 2022, direct investment flows remained characterised by divestment operations both for assets (down €12 billion) and for commitments (down €26 billion). These operations concerned a few SOPARFIs which continued their operations to restructure, terminate or relocate their activities.

Regarding portfolio investments, following the increased uncertainty in the financial markets, transactions in Luxembourg equities resulted in net outflows of €34 billion in the first half of 2022, compared to inflows of €130 billion during the same period in 2021. Luxembourg debt securities, on the other hand, suffered net inflows of €0.5 billion in the first half of 2022. Transactions in foreign equity securities resulted in net purchases of €25 billion, compared to outflows of €92 billion in the first half of 2021. For their part, foreign debt securities suffered net outflows, amounting to €41 billion in the first half of 2022, compared to net outflows of €17 billion the year before.

Detailed statistical tables are available online on the websites of the BCL (www.bcl.lu) and Statec (www.statistiques.public.lu).