Credit: Statec

Credit: Statec

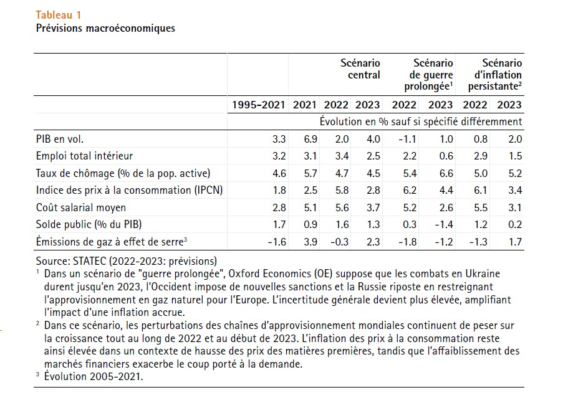

On Tuesday 7 June 2022, Luxembourg's statistics agency Statec announced that it is revising its gross domestic product (GDP) growth forecasts downwards to 2.0% for 2022, whilst a rebound of 4.0% is expected in 2023, provided that the geopolitical context improves and prices do not soar further.

According to Statec, the current economic environment is characterised by an increase in supply issues, in particular due to the consequences of the conflict in Ukraine and, thus, the simultaneous upward price adjustment will eventually weigh on demand and should limit the expansion of the Luxembourg economy to 2% this year.

Europe remains less subject to the effects of the pandemic, but affected by the conflict in Ukraine

The year 2022 began auspiciously, with the prospect of activity being liberated from a large part of the constraints associated with the COVID-19 pandemic. The war in Ukraine since the end of February, and the severe restrictions applied in China to deal with the resurgence of the coronavirus, have clouded the economic outlook. These two new shocks exacerbate the difficulties that already existed beforehand, namely increasing inflationary pressures and supply issues linked to the so-called "post-COVID" recovery. These difficulties, which may initially have appeared to be transitory, have in fact become a phenomenon that will have a more lasting and widespread impact on the economic situation.

The European Union (EU) is particularly exposed to the consequences of the conflict due to its proximity to Russia (geographic and economic, especially in terms of its hydrocarbon supplies). Growth in the euro zone for this year is expected to remain below 3%, compared to the 4.5% expected in the autumn of 2021. The risk of aggravation is high, however, both in terms of the development of the conflict and the disruption of global supply chains. If they were to materialise, they could drag the euro zone into a recessive dynamic and limit expansion to just 1% in 2022.

Growth revised downwards for Luxembourg in 2022, many uncertainties for 2023

As in the euro zone as a whole, confidence in Luxembourg has taken a hit since the start of the conflict in Ukraine. This is particularly the case for consumers but also applies to industry and the retail sector. Sentiment in non-financial services has held up better, thanks to the relaxation of restrictions.

While Luxembourg has relatively little exposure to Russia in terms of trade in goods and services, the indirect effects of the consequences of the conflict are already being felt because of increased price pressure, rising interest rates and the feverishness of financial markets. For sectors such as industry, construction and certain trade entities, supply difficulties will increase, fuelled further by the blockages linked to the restrictions imposed in China.

Luxembourg's GDP is expected to grow by 2% in volume this year, a significant downward revision from the 3.5% still envisaged in the "Note de conjoncture" (economic report) published in December 2021. Growth would be 4% for 2023 and would be mainly supported by activity and exports in non-financial services, as was the case in 2022. After two good years 2020 and 2021, the financial sector is expected to slow down in 2022 mainly due to the deterioration in the stock market environment. The current context is generating a great deal of uncertainty around these forecasts and the risks of downward revisions to growth, for this year and next, are dominant.

An explosive cocktail for inflation

Inflation in Luxembourg and the euro zone reached its highest level in forty years in the spring of 2022. While the surge in energy prices is largely the main cause, increased inflationary pressures have spread to other goods and services. The expected easing is lagging behind due to the outbreak of the war in Ukraine and strict containment measures taken in China, which are causing further disruptions to the supply chain and an increase in base prices. Statec now expects inflation to be very substantial this year, at 5.8%, before slowing to 2.8% in 2023. This easing would mainly result from a loss of momentum in oil price increases, whereas underlying inflation is expected to remain high.

While wages in the euro zone are still little affected by high inflation rates, greater pressures are expected at this level in Luxembourg. Statec expects wage inflation to be higher than in the euro zone in 2022 following the triggering of two index brackets over a very short period of time (October 2021 and April 2022). This surge can, at least in part, be linked to labour shortages. In historical comparison and based on real wages, the increase does not yet appear exceptionally high.

The labour market remains strong in 2022, however it is expected to suffer next year.

Employment is continuing to rise sharply in the euro zone and in Luxembourg, while unemployment remains on a downward trend and tensions linked to labour shortages persist. The most recent data however show a slightly less favourable trend in the euro zone at the start of 2022.

Unemployment in Luxembourg reached 4.7% in March 2022, the lowest level since December 2008. Job creation was still very strong in the first quarter of 2022, with a rate of 3.7% year-on-year, however unfavourable base effects are expected to lead to a slowdown thereafter.

The downward revision of the activity growth outlook is expected to come into play from 2023 onwards. The increase in employment would lose one percentage point in the baseline scenario and the materialisation of risks would add another layer due for example to a protracted war or increased pressure on consumer prices. The unemployment rate would hence be between 4.5% and 6.6% in 2023, depending on the scenario.

Public finances should be resilient, despite the deteriorating economic environment

In Luxembourg, as in other countries, the State assumed its stabilising role in the face of the pandemic crisis in 2020, which resulted in significant public deficits. Yet the recovery of public finances has been rapid, at least in Luxembourg, where a surplus of nearly 1% of GDP was recorded in 2021.

Tax revenues remained particularly favourable at the start of 2022 and should continue to be boosted in the short term by the expansion of certain tax bases due to the inflationary surge. The deterioration of the outlook for real growth in response to the outbreak of the war in Ukraine is playing in the opposite direction, but its impact remains limited, at least in the baseline scenario. According to Statec forecasts, total revenue would increase by almost 8% in 2022 and by just under 6% in 2023.

On the other hand, the inflationary drift is driving up spending via the paid index brackets (although their number has been restricted to two for 2022-2023) and due to the measures announced to help economic players cope with the shock. The increase in spending would nevertheless remain close to the historical average with a nominal increase of around 6% in both 2022 and 2023. The public balance would therefore improve slightly and be close to 1.5% in 2022 and 2023.

Greenhouse gas emissions are confined by rising energy prices.

European energy markets are suffering a historic shock. The upward pressure on prices stems from a confluence of current events (including the conflict in Ukraine and the surge in global demand following the COVID-19 crisis) and long-term trends, such as increasing carbon prices. While the energy transition requires a gradual reduction in the use of fossil fuels, the invasion of Ukraine created a desire to reduce Europe's dependence on fossil fuels more quickly.

The surge in energy prices in European markets has spread to consumer prices. Fuel and heating oil prices have reached unprecedented levels, forcing European governments to intervene in order to maintain household purchasing power. The magnitude of the price increase has had a profound impact on production costs for energy-intensive industries. The direct impact on the Luxembourg economy should however be limited because it relies mainly on low-energy services.

While the temporary reduction in fuel prices is expected to boost sales to international carriers, high energy prices are expected to lead to lower gas and heating oil consumption. The increase in emissions from diesel sales would thus counterbalance the decrease in non-transport greenhouse gas emissions. Statec expects total emissions to stagnate in 2022 and to rise by about 2.5% in 2023.