Credit: STATEC

Credit: STATEC

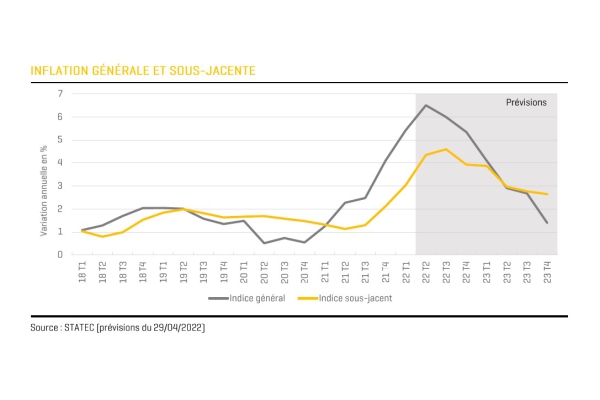

Luxembourg's statistics agency Statec has announced that it is revising its inflation forecasts for 2022 and 2023 upwards again, to 5.8% and 2.8%, respectively.

According to Statec, the outbreak of war in Ukraine and strict containment measures in China should make a certain number of raw materials more expensive and further disrupt supply chains. These new elements would thus tend to intensify and prolong inflationary pressures, which are currently very substantial. Upside tensions diffuse and affect a wide range of goods and services.

In Luxembourg, the inflation rate reached 7.0% in April over one year, its highest since the spring of 1984. Petroleum products contributed 3%, but the underlying inflation was also on a very dynamic trajectory, rising to 4.2% in April. The tensions have intensified and become generalised: more than 70% of the products from the price index show an annual increase of more than 2%, while for almost half of the increase even exceeds 4%.

This dynamism is partly explained by factors prior to the conflict in Ukraine, namely the lags between the recovery of supply and demand at the end of the COVID-19 crisis, particularly a rebound in the price of fuel and a surge in gas prices since last summer. It was expected at the beginning of the year that these upward pressures would dissipate during 2022, the war in Ukraine and the maintenance of the "zero COVID-19" strategy in China (generating large-scale closures of factories and ports) are again massively disrupting the logistics chain.

The increase in the price of Brent, as temporarily reaching to $130/barrel at the beginning of March, immediately inflated the consumer prices of heating oil and fuels in Luxembourg. The impact of soaring gas, certain prices of metals and food products (particularly wheat) for which Russia and Ukraine are also major suppliers on a world scale, is less direct and will reverberate from staggered and gradual way on the final prices.

Over the next few quarters, core inflation should therefore continue to be stimulated by bottlenecks and energy prices (with an indirect impact via production and transport costs). At the euro zone level, additional pressures could come from a depreciation of the euro. These forecasts count on a strengthening of the euro against the US dollar from 1.11 in 2022 to 1.17 in 2023 (trajectory from Oxford Economics) while the exchange rate has just fallen to 1.05 at the beginning of May. This weakening constitutes an upside risk for the forecast in the sense that the depreciation tends to make imported goods more expensive.

A marked acceleration in wages in the euro zone (not yet observed but probable given the shortages of labor and the inflation suffered) could also prolong the inflationary surge. In Luxembourg, inflation in Services sector (up 4.4% over one year in April) has already been fueled in recent months, among other things, by the two index tranches paid in October 2021 and April 2022.

The context of the war greatly increases the uncertainty surrounding these forecasts, particularly with regard to the future evolution of energy prices, which have been extremely volatile since the outbreak of the conflict. However, the scenarios presented by Statec do not count on a suspension of Russian gas deliveries to Europe. Uncertainty also concerns the impact of increases in energy commodity prices on end prices, gas and electricity in particular (increases have been integrated from the end of 2022).

On the other hand, the uncertainties and disturbances relating to the war are degrading the economic environment, which will have a moderating impact on inflation. This one is however largely dominated by the aforesaid bullish pressures. Thus, in the forecasts of international institutions published recently, downward revisions of growth go hand in hand with upward revisions of inflation. In its forecasts published in April, the International Monetary Fund expects an inflation rate of 5.3% for the euro zone for this year, then a slowdown to 2.3% in 2023.

For Luxembourg, Statec anticipates 5.8% inflation for 2022 (against 4.4% in the February forecast) and 2.8% for 2023 (against 1.3% estimated previously). The slowdown by 2023 is explained on the one hand by a certain slowdown in underlying inflation, the pace of which should however remain very sustained (up 4.0% in 2022, then up 3.1% in 2023). In addition, the price of petroleum products would decline, according to forecasts from Oxford Economics, from around $100/barrel on average for this year to just under $85/barrel in 2023.

This forecast incorporates the moderating impact of several temporary measures decided within the framework of the "Energiedesch" and the "Solidariteitspak" (tripartite agreement). The abolition of the contribution to the network for gas, the temporary reduction in the contribution to the compensation mechanism for electricity, the reduction of 7.5 cents/litre for diesel, gasoline and fuel oil and the shift in the index brackets generate together a reduction in the inflation rate of 0.% for 2022 and 0.2% for 2023 (compared to a scenario without the above measures).

According to these inflation forecasts, a new index line would already be triggered in June 2022 and should therefore be applied, in the absence of a lag, in July. Still in the absence of a shift, the subsequent tranche would be triggered according to these forecasts at the end of the first quarter of 2023. In accordance with the "Solidariteitspak", the application of these two tranches will be postponed to April 2023 and April 2024.

Due to the volatility of the price of crude oil, Statec assesses the mechanical impact of alternative prices in high and low scenarios (deviations based on the historical volatility of the price). The alternative scenarios are also distinguished by rhythms of progression of the underlying slightly adapted to the rise or to the fall. In all of these Scenarios, a new index tranche would be triggered in June 2022 (and paid out in April 2023). In the high and central scenarios, the triggering of the subsequent tranche would fall in the 1st quarter of 2023, but only in the 3rd quarter of 2023 in the low scenario (payment in April 2024).