On Monday 21 June 2021, during a joint meeting of the Finance and Budget Committee (Cofibu) and the Budget Execution Control Committee (Comexbu), Luxembourg's Minister of Finance, Pierre Gramegna, provided an update on the State's financial situation as of 31 May 2021 in which he underlined his optimism for the future.

“At the end of May, public finances improved further, confirming the economic recovery already observed in recent months. I am particularly delighted with this favourable development in public revenue and expenditure, with a gradual return to normality which is now shaping up to be”, underlined Minister Gramegna.

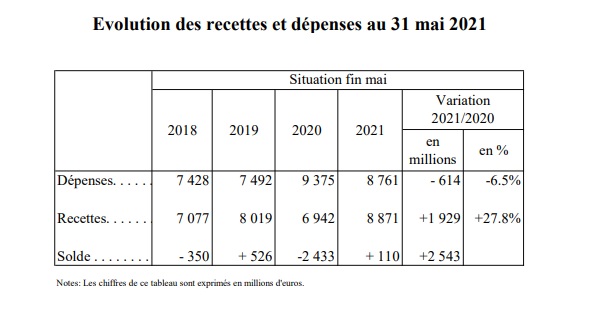

As of 31 May 2021, total revenues have increased by +27.8% compared to the first five months of 2020. The figures must be considered in the light of the particular situation in 2020 characterised by the restrictive measures decided at the time to stem the spread of COVID-19. And this with the consequence of a pronounced closure of large parts of the economy, having caused a spectacular fall in revenues.

As for public expenditure, these decreased by -6.5% on an annual basis. According to the Ministry of finance, the decrease compared to 2020 testifies to the immense extraordinary effort in favour of companies and citizens of the past year, to face the crisis, and therefore heralds a return to normality in the evolution of spending. Thanks to the positive effect, with rising revenues and falling expenditure, the central government budget balance observed as of 31 May 2021 has therefore improved markedly, posting a surplus of €110 million.

With regard to the breakdown of public revenue, the Tax Administration (ACD) collected revenue amounting to €4,221 million at the end of May 2021, which represents an increase of €688 million, i.e. an increase of 19.5% compared to the end of May 2020. The a priori spectacular evolution must be qualified insofar as the figures for 2020 were particularly low in view of the direct consequences of the COVID-19 pandemic as well as due to the delays payments and cancellations of advances granted last year. Compared to the end of May 2019, total ACD revenue increased by €343 million, equivalent to an annual growth rate of 4.3%.

The revenue collected by the Registration, Domains and VAT Administration (AED) at the end of May amounted to €2,839 million and increased to €809 million, i.e. 39.8% compared to the previous year. Even if this development is undoubtedly favourable for the moment, the progression should again be considered in the particular context of 2020 when the AED accelerated these repayment operations and applied an administrative tolerance in favour of taxpayers. Compared to the end of May 2019, AED's revenues increased by €475 million, an annual growth rate of 9.6%.

Finally, the Customs and Excise Administration (ADA) received revenue of around €670 million, which represents a positive variation of €91 million, i.e. a gain of +15.7% compared to the total for the first five months of 2020. Sales of diesel fuel and gasoline remain at a low consumption level of -27% and -24% respectively compared to 2019, i.e. the reference year without pandemic and without CO2 tax. Teleworking and reduced mobility as part of health measures are the main factors, as is the reduction in the fuel price differential with neighbouring countries due to the introduction of the CO2 tax. It is therefore clear that the latter contributes positively to the achievement of reduction objectives in terms of greenhouse gas emissions.

The receipts collected by the three administrations represent 46.6% of the voted budget, which corresponds to collections which are higher than budgetary expectations, namely the 5/12 or 41.6% which would be reached after five months in the event of linear evolution.

In terms of public spending, these amounted to €8,761 million at the end of May 2021, a decrease of 6.5% on an annual basis. This favourable development is explained by the extraordinary expenses incurred during the same period in 2020 as part of efforts to stabilise the economy and safeguard jobs and the purchasing power of households. To this end, it is above all necessary to increase social benefits in cash, which include in particular expenditure on short-time working, which has decreased by €501 million (35%) compared to the first five months of 2020. During this period, the State had taken an important extraordinary measure, by disbursing the large payments for short-time working in advance. Short-time working expenses fell during the period under review by €520.6 million, or 62.4%. Excluding a purely accounting transaction, direct and indirect investments fell by €78 million, or -9.5% compared to the end of May 2020. This is notably linked to the extraordinary costs incurred in 2020 through aid disbursed in favour of small and medium-sized enterprises and infrastructure investments linked to COVID-19.

In conclusion, the Minister of Finance commented “The figures at the end of May confirm once again that the improvement in the budgetary outlook is in the process of materialising. I am very satisfied with the positive development of public finances, which is also the consequence of a prudent financial policy and at the same time anxious to support companies in coming out of the crisis. With the easing of health restrictions and the rapid advancement of the vaccination campaign, the economy is recovering as citizens' daily lives return to normalcy."