Credit: Statec

Credit: Statec

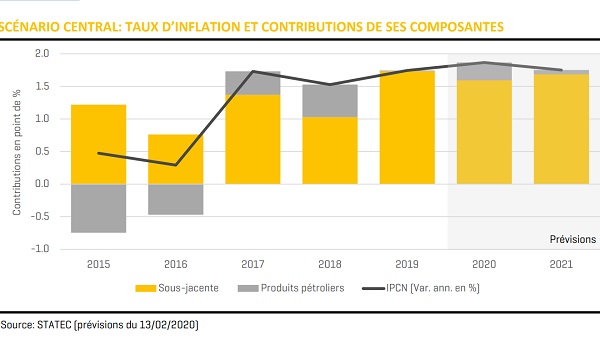

The national statistical agency Statec has announced that it anticipates a slight increase in inflation in Luxembourg, approaching 2% in 2020 and 2021.

This predicted increase is attributed mainly to higher petroleum product prices. Indeed, the forecasts take into account the introduction of free public transport on 1 March 2020 and a further increase in excise duties on fuels expected for the coming months.

Inflation rose at the start of 2020 with 1.9% year-on-year in January. In addition to the prices of petroleum products, the new index bracket in January, a marked increase in the price of electricity (almost 10% over a month) and a rise in food prices contributed to this increase. Nevertheless, the introduction of free public transport in March is expected to significantly reduce inflation. Based on the information currently available, the impact is estimated at -0.3%.

Compared to forecasts published in November 2019, Statec has revised expected inflation for 2020 up to 1.9% (+0.3%). Inflation is expected to remain higher than that of the euro zone, which has not exceeded 1.5% for almost seven years and still does not show any signs of significantly rising. According to Statec, the increase in Luxembourg reflects higher prices observed in January for gas as well as for fuels which stem from the increase in the regulatory share of biofuels. Added to this is the inclusion in the forecast of the announced increase in excise rates for the current year, from 1 to 3 cents per litre of petrol and from 3 to 5 cents of diesel between February and April .

Statec has clarified that these forecasts do not yet take into account the introduction of a CO2 tax from 2021 following the uncertainties surrounding the precise conditions of this measure. The latter would also concern not only fuel prices but also those of gas and fuel oil.

The forecast for the Brent crude oil price implicitly considers a rebound from the very low levels recorded at the beginning of February (around USD $54 per barrel). Due to the volatility of crude oil prices, Statec has assessed the mechanical impact of alternative prices in a high scenario (the price of a barrel of Brent deviates each month by an additional USD $1 from the trajectory of the central scenario) and low (down USD $1 per month). According to the different scenarios, the next index bracket would be triggered between the first and the third quarter of 2021.