Credit: Bâloise Assurances Luxembourg

Credit: Bâloise Assurances Luxembourg

Bâloise Luxembourg has announced the launch of "Switch Plan", the first 100% sustainable life insurance policy

As part of its corporate social responsibility (CSR) efforts, and accompanied by its partner etika asbl, Bâloise has launched Switch Plan: a more humane, fairer and more respectful investment, through sustainable and responsible funds developed specifically for Bâloise.

This new product incorporates environmental, social and governance (ESG) values, fundamental criteria which today guide investors wishing to create value and focused on sustainable development principles. These criteria make it possible, in the first instance, to assess and verify the responsibility of the companies or economic sectors in which the premiums of life insurance policies are invested, with regard to the environment, their social impact and management. They also measure the ethical impact of these investments.

This new life insurance policy is part of a comprehensive approach by Bâloise, supported by etika, for more sustainability in the investment and insurance sector. The partnership, signed at the beginning of 2020 between the insurer and the non-profit association, provides for the development of ethical insurance products to meet the needs of new consumer concerns. etika contributes its expertise by providing ideas for improvement in a more sustainable and responsible way of working within Bâloise, but also for reflecting on an alternative economy in the same direction.

In addition, Baloise Group signed last year the Principles for Sustainable Insurance (PSI), developed by the United Nations Environment Programme Finance Initiative (UNEP FI). The Group is thus committed to systematically integrating ecological, social and business management aspects into its whole production chain.

Romain Braas, Director - General Manager of Bâloise Luxembourg, explained: “Our customers are now aware of the importance of a real ecological and social commitment, they are concerned about environmental issues and want to make a contribution to our society. The impact of their efforts at all levels is now a priority, and also guides their investment choices. This new Switch Plan product responds to the aspirations of these clients, in order to support them in their responsible approach”.

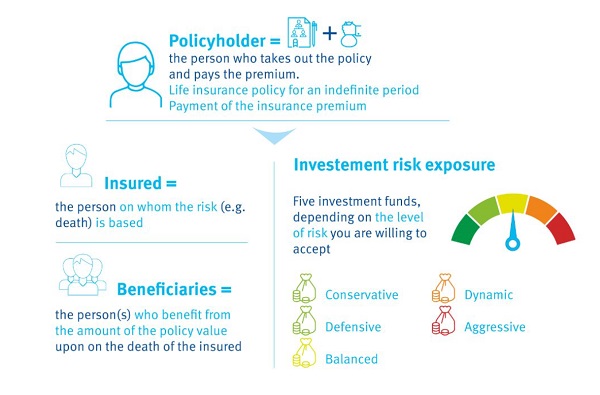

Like any life insurance policy, Switch Plan enables customers firstly to transmit capital to family and friends, but also to have it available at any time to finance their projects. The management of this product is carried out by a professional manager in a flexible way, adapted to the investor’s profile in accordance with his / her tolerance for risk.

Internal collective funds are managed by Degroof Petercam Asset Management (DPAM), an independent asset manager whose expertise ensures that customers invest their life insurance premiums in responsible funds which incorporate ESG criteria.