Credit: STATEC

Credit: STATEC

STATEC published a report this week on the construction sector in Luxembourg.

The report indicated that the construction sector is showing little sign of recovery. Activity and employment continued to fall in the first half (H1) of 2024, while business confidence has stabilised at a "very low" level. Whilst the property market is beginning to improve, STATEC argued this would not have a significant impact on construction activity in the immediate future.

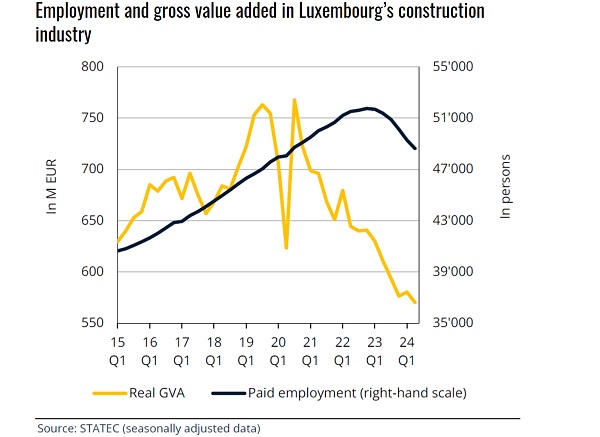

Although Luxembourg's economy as a whole experienced growth in H1 2024, gross value added (GVA) in real terms in construction continued to decline (by 7.2% year-on-year).

While the construction of buildings was still experiencing steeper falls in activity than other segments in 2023, the declines in GVA were more comparable in H1 2024: down by 8% year-on-year for building, down 8% for civil engineering and down 7% for specialised activities.

STATEC noted similar trends in the eurozone, where construction activity dropped by 0.8% year-on-year in H1 2024. The decline in GVA in countries such as Germany, France and the Netherlands has particularly contributed to this poor performance, which has been partially offset by sustained growth in construction in Italy and Spain. STATEC noted that the decline in the construction industry is "much more pronounced" in Luxembourg than in the eurozone, with a GVA decline of about 16% since the start of 2022, compared with a drop of 8% in Germany and 1% in the eurozone.

Confidence in the sector in Luxembourg has deteriorated accordingly since 2022, according to the report. However, the latest data seem to point towards a certain stabilisation - albeit at a low level and "well below" its long-term average. STATEC attributed this to a slight improvement in the employment outlook since April 2024. Moreover, the net proportion of companies constrained by a shortage of manpower recently stopped falling. On the other hand, opinions regarding the state of the order book are continuing to decline. STATEC added that the proportion of companies witnessing insufficient demand remained historically high at 55% in September.

The number of bankruptcies in the construction sector remained high in Q3 2024, particularly for building construction firms. At the same time, the number of new business registrations in the construction industry has fallen to an all-time low.

Employment in the construction sector has continued to decline since the beginning of 2023, although this has been less pronounced in recent months. The biggest job losses still concern the building sector, but a growing proportion are in specialised work. STATEC said the crisis seems to have affected more and more trades involved in the latter stages of construction.

In neighbouring countries, construction employment is also on the decline, but to a lesser extent (on average -0.3% over a quarter in Q2 2024 compared with -1.3% in Luxembourg), while employment in the eurozone is rising under the influence of certain southern countries.

In the second quarter, investment in construction projects continued to fall (for the sixth quarter in a row). In addition, building permits fell sharply (-40% year-on-year) for both residential and non-residential buildings.

The STATEC report indicated, however, that the housing market is showing signs of a turnaround. More mortgages are being granted and the expected further fall in interest rates is expected to sustain this recovery. Furthermore, housing transactions have started to rise again, as have prices, reflecting the gradual return of demand. Nevertheless, many current transactions involve existing homes. In Q2, for example, new-build properties (those capable of sustaining construction activity) accounted for less than 15% of apartment transactions, compared with the historical average of 36%.

The report also indicated that consumer morale remains low.

Moreover, demand for loans from companies has not yet picked up in Luxembourg (as well as in half the eurozone countries) due to the weakness of fixed investment. The report added that banks are continuing to refuse certain loan applications from SMEs. New loans granted by Luxembourg banks to businesses fell by a further 3% year-on-year over the summer, reaching historically low levels.

Regarding inflation and wages, the report suggested that the gap between wages and consumer prices has been narrowing since the start of 2024. According to an initial estimate, the compensation per employee fell by 1.3% over one quarter in Q2, after already slowing from +1.3% to +0.2% between Q4 2023 and Q1 2024.

In the eurozone, on the other hand, wages have shown little dynamism over this period compared to the surge in prices in 2022 and 2023. But here too the gap has narrowed "considerably" since 2024.

Looking at household waste collection prices, STATEC said these rose "sharply" in Luxembourg's consumer price index in July (+13% over one month), largely owing to the rise in rates charged by the SIDEC intermunicipal association in the north of the country. This increase came after several years of stable prices, according to the report.

Since January 2020 (and until September 2024), the cost of waste collection has risen by 12% in the eurozone, more specifically by 12% in France, 13% in Germany, 16% in Belgium, 17% in Luxembourg (+3% only until June 2024) and 22% in the Netherlands.

Against this backdrop, STATEC noted that for other municipal tariffs, such as water supply and wastewater collection, price trends in Luxembourg remain relatively low compared with neighbouring and other eurozone countries (about +8% between January 2020 and September 2024, compared with +15% over this period in the eurozone).

Reflecting on the labour market, STATEC noted that the employment outlook (based on business surveys) does not suggest any short-term upturn in employment. It improved slightly in Q2, but fell back again in Q3, in line with other economic signals. Economic activity picked up significantly in the first half of the year, but this trend has not yet extended to employment, which continues to grow at a historically low rate.

Looking at energy, STATEC recalled that fuel sales fell by 2% in 2023 - a trend that is continuing in 2024. Over the first eight months of the year, sales dropped by 4% compared to the same period in 2023. STATEC attributed this decline to diesel sales, which fell by 7%, while petrol sales rose by 3%.