Taxation of capital gains in cryptocurrency goes from 0% to 42% in Luxembourg;

Credit: Waltio

Taxation of capital gains in cryptocurrency goes from 0% to 42% in Luxembourg;

Credit: Waltio

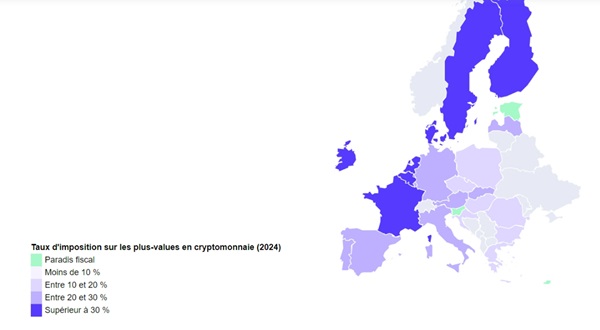

HelloSafe, a platform for comparing financial products (insurance, loans, investments) in more than ten countries around the world, has published an overview of the rules in force to provide more information on the rules of taxation on cryptocurrencies in various European countries.

Faced with the emergence of cryptocurrency in the financial landscape for more than a decade now, the governments of the European Union countries have reacted by adopting a set of very disparate tax rules. When it comes to taxation on cryptocurrencies, the rules are far from being harmonised among the 28.

The data on this map, provided by Waltio, a crypto tax assistant compliant, was updated in March 2024. In the case of countries that have implemented a progressive tax rate on capital gains made in cryptocurrency, the value taken into account for the card corresponds to the median of the highest rate and the lowest rate. The asterisk that appears at the end of certain popups indicates that tax exemption is possible in the country under certain conditions.

In 2024, strong disparities in taxation on capital gains in cryptocurrencies remain between the 28 countries of the European Union, which apply different rules from each other, some completely exempting this income from tax, others taxing them very heavily. As of 1 March 2024, four EU countries continue not to tax capital gains on cryptocurrencies. These are Cyprus, Estonia, Malta and Slovenia.

On the other hand, the countries of Northern Europe are those which tax these profits the most, with tax rates reaching up to 50.5% in Germany, 52.06% in Denmark, 30%. in Sweden or up to 44% in Finland.

As for the Benelux zone, the taxation of capital gains in cryptocurrency is also high, with rates which can reach 50% in Belgium, 42% in Luxembourg or even 31% in the Netherlands (the latter country taxing based on the portfolio held and not the capital gains realised). In Luxembourg, exemptions on income from tax apply if held for at least six months or if one's total annual capital gains were less than €500. As for France, it applies a single tax rate of 30%.

Emilie Jurdic, Legal Manager at Waltio, said: "Many European countries have implemented taxation on gains made in cryptocurrencies. Although the rates may vary from one country to another, this table nevertheless only presents the taxation of capital gains, i.e. gains received in the event of the sale or trading of a cryptocurrency. It is important to emphasise that the majority of States have implemented different and specific taxation on the receipt of passive gains (income from staking, farming, etc.). for practical reasons, this taxation has not been presented in the table but nonetheless remains non-existent. [...] Each country has complex taxation which differs depending on the type of transaction. This table also does not take into consideration the possibility or not of capital losses being carried forward over time."

The European Union plans to introduce a new tax on cryptocurrencies for companies from 1 January 2026, HelloSafe added. This legislation should concern any company whose activities are linked to cryptocurrencies (traders, brokers, etc.) and which offers services to European residents. These companies would thus be required to declare all of their transactions. This law should make it possible to regularise gains made in cryptocurrency and thus fill a shortfall estimated at nearly €93 billion in 2020 by the European Commission.