On Tuesday 17 March 2020, Luxembourg's Ministry of Finance announced the introduction of several tax measures aimed at supporting businesses and people who are self-employed in light of the coronavirus crisis.

Faced with the crisis linked to the spread of coronavirus, the Luxembourg government has decided to implement various tax measures in favour of legal and natural persons. The main objective of these measures is to alleviate the financing and liquidity needs of businesses and self-employed people which are strongly impacted by current economic restrictions.

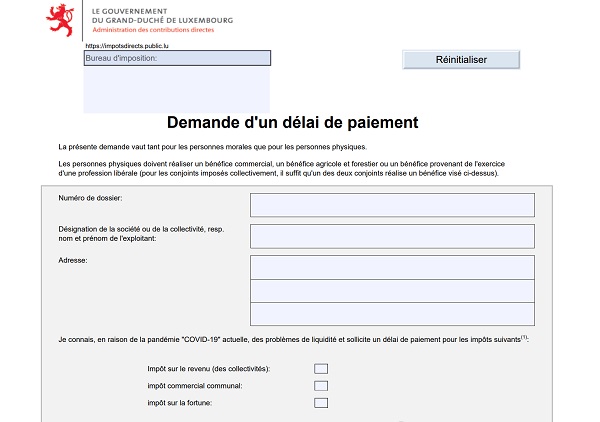

In terms of direct taxes (impôts directs), facilities for tax advances and payment terms will be granted to businesses and self-employed people. More specifically, legal and natural persons carrying out an activity generating a commercial profit, an agricultural and forestry profit or a profit arising from the exercise of a liberal profession and who are experiencing liquidity problems due to the coronavirus pandemic can request the cancellation of tax advances for the first two quarters of 2020. This measure covers income tax (impôt sur le revenu; for local authorities) and municipal commercial tax (impôt commercial communal).

In addition, these same persons may request a four-month payment period for taxes due after 29 February 2020. This payment period will not incur late payment interest and covers income tax (impôt sur le revenu; for local authorities), municipal sales tax (impôt commercial communal) and wealth tax (impôt sur la fortune).

To benefit from these measures, business owners and people who are self-employed are asked to send the respective forms to the Direct Tax Administration (Administration des contributions directes). These forms are now available from https://impotsdirects.public.lu/. The request is automatically accepted upon receipt by the administration. The deadline for submitting tax returns has been extended to 30 June 2020. This decision applies to both legal and natural persons. The deadline for submitting, revoking or modifying a request for individual taxation is postponed to the same date.

In terms of indirect taxes (impôts indirects), the Administration of Registration, Domains and VAT (Administration de l'enregistrement, des domaines et de la TVA) will reimburse all VAT credit balances below €10,000 from this week on. This measure is expected to meet the liquidity needs of around 20,000 companies established in the Grand Duchy.