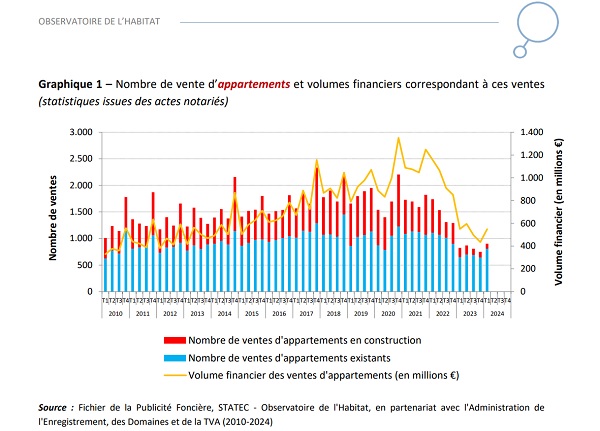

Number of apartment sales and financial volumes corresponding to these sales (statistics from notarial deeds);

Credit: (Source) STATEC, Housing Observatory, in partnership with Registration Duties, Estates & VAT Authority

Number of apartment sales and financial volumes corresponding to these sales (statistics from notarial deeds);

Credit: (Source) STATEC, Housing Observatory, in partnership with Registration Duties, Estates & VAT Authority

On Wednesday 26 June 2024, Luxembourg's Housing Observatory published the results of its latest report on the real estate market.

This report takes stock of developments in activity, sales prices and rents announced for residential real estate in the first quarter of 2024.

The main observations are summarised as follows:

- activity in the real estate and residential land markets remains at levels well below those recorded before the real estate crisis, particularly for new construction. However, there has been a slight pick-up in activity on the existing apartment market this quarter;

- the slowdown in the fall in prices that began in the previous quarter has been confirmed: -0.3% between the fourth quarter of 2023 and the first quarter of 2024 according to the STATEC index (compared to -6.6% between the second and third quarters of 2023, then -2.1% the following quarter). However, housing prices remain down over twelve months: -10.9% between the first quarter of 2023 and the first quarter of 2024;

- announced apartment rents have stabilised since the second quarter of 2023 (despite a slightly stronger increase in the fourth quarter of 2023). Over the last twelve months, the increase in announced apartment rents has remained contained: +1.5% between the first quarter of 2023 and the first quarter of 2024. It was thus lower than that of consumer prices measured by the national consumer price index (IPCN) (+3.2%) over the same period.

More detailed findings:

Number of housing sales

In the first quarter of 2024, activity in the real estate and residential land markets remained at levels much lower than those recorded before the real estate crisis began towards the end of 2022, and this affects all segments.

The apartments under construction (VEFA) segment in particular has seen a sharp decrease in the number of transactions since the start of 2023, reaching only 92 sales this quarter (-47.1% compared to the first quarter of 2023). The number of transactions was thus seven times lower than the average for the years preceding the crisis (667 sales of apartments under construction in the first quarter on average between 2017 and 2022).

On the other hand, the Housing Observatory noted a slight boost in activity in the existing apartment segment in the first quarter of 2024: respectively +24.5% and +11.9% for the number of transactions and the associated financial volume compared to the first quarter of 2023. Activity in this segment, however, remains below the average for the years preceding the crisis (1,002 sales on average in the first quarter of years 2017 to 2022).

Real estate prices

The housing sales price index provided by STATEC (including both existing housing and housing under construction) suggests a clear slowdown in the fall in prices this quarter: only -0.3% between the fourth quarter of 2023 and the first quarter of 2024 (compared to -6.6% between the second and third quarters of 2023, then -2.1% the following quarter). However, house prices remain down over twelve months: -10.9% between the first quarter of 2023 and the first quarter of 2024.

The slowdown in the fall in prices affects both segments of existing properties: -0.2% compared to the fourth quarter of 2023 for existing apartments and +0.6% for existing houses. Over twelve months, however, the decline was clearer: -12.4% for existing apartments and -14.7% for existing houses compared to the first quarter of 2023.

On the other hand, the sales prices of apartments under construction (VEFA), which were the least affected by the drop in prices, were down this quarter (-2.3% compared to the fourth quarter of 2023). The Housing Observatory added that developments in this segment are very volatile at present, since the number of transactions here is very limited. It recalled that in this segment, it is always an adjustment by activity volumes that dominates, more than an adjustment by prices.

Announced rents

After several quarters of sharp increases (in particular from the second quarter of 2022 to the first quarter of 2023), announced apartment rents have stabilised since the second quarter of 2023, despite somewhat volatile developments. Over the last twelve months, the increase in announced apartment rents has remained contained: +1.5% between the first quarter of 2023 and the first quarter of 2024. It was lower than that of consumer prices measured by the IPCN (+3.2%) over the same period.

According to the Housing Observatory, the fairly clear slowdown in the increase in rents announced since mid-2023 is most likely explained by the financial constraints on the income of tenants, who could not absorb large increases in rents requested by lessors, despite the strong rental demand, generated in particular by the postponement of part of the demand away from home ownership (made more difficult by the sharp and rapid increase in interest rates) towards rental.

In the rather specific segment of furnished room rental, which currently represents around 15% of the total rental supply, the increase in rents was higher: +4.5% compared to the first quarter of 2023. The Housing Observatory noted that this increase is significantly higher than that for the indicator of announced rents for apartments (unfurnished), and even higher than inflation on consumer goods.

Moreover, the Housing Observatory recalled that these are the rents requested by lessors for new rental contracts. The increase in rents during the lease (for tenants who do not change accommodation) also remained relatively moderate. It is currently significantly lower than inflation on consumer goods according to STATEC statistics: +1.5% for the rent index between the first quarter of 2023 and the first quarter of 2024, compared to +3.2% for inflation on consumer prices measured by the IPCN.