Luxembourg's Housing Observatory (Observatoire de l’habitat) has published a new study on the emergence of rental housing with shared spaces and/or rented for short periods via online platforms; for the first time, an exploratory analysis of this emerging market offers a detailed view of these types of housing as well as the new intermediary players involved and highlights the challenges that the rise of digital technologies imposes on real estate players and public authorities.

In addition, the Housing Observatory has also updated (for the period 2022-2024) its study on the impact that the geographical location of a dwelling can have on the requested rent, based on a hedonic modelling of the advertised rents.

Typology of shared, short-term and digitalised rental housing

For several years, the Luxembourg real estate market has been facing the emergence of new types of flexible rental housing known as "shared", often available for short periods and whose management benefits from the rise of online platforms. This phenomenon has been observed in tense urban contexts, where real estate players offer these types of housing in response to the growing difficulties in accessing private property and renting independent housing. These flexible products of relatively high standing, developed through specialised rental management companies, are of interest to (a) owners (for their high rental yield and occupancy rates), (b) public authorities (to compensate for the lack of housing for foreign workers) and (c) users (to access flexible, furnished housing and possibly a community). However, the development of this type of rental offer is not without risks (price instability, exclusion of certain types of households). It is therefore essential to better understand the nature and mode of operation of these segments of the rental market, which seem to be growing rapidly in Luxembourg.

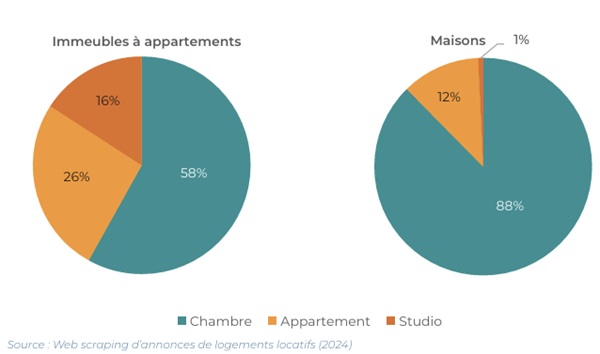

This note proposes a typology of shared, short-term and digitalised rental housing in Luxembourg. These housing units can be seen as professionalised forms of shared accommodation and furnished room rental. Based on the extraction of data from the advertisements of twelve companies, it proposes a typology focusing on co-living and short-term rental, these two segments being the most present in Luxembourg.

In terms of housing typology, two main observations were made:

The concentration of supply in Luxembourg City and its suburbs, and to a lesser extent around Esch-Belval in the south of the country, consistent with the location of the target audience and the search for increased profitability by landlords in these areas with a high level of pressure.

The great variability in the types of products offered and their spatial configuration. While rents advertised per square metre are generally high, there is a great disparity from one company to another and within their portfolio.

The analysis of the strategy of specialised intermediary companies, which intervene between owners and tenants, highlights three other key elements:

- The companies are diversifying their offer to provide a range of solutions according to the target audience's life path.

- This diversification of unit types, rental durations and ad distribution platforms, as well as the rapid growth of the companies, makes it difficult to monitor the evolution of these new segments of the rental market.

- Companies work closely with employers and position their offer to these partners as a solution to the talent attractiveness crisis. This is an illustration of the close link between the housing and labour markets.

The note allows us to question the challenges of shared, short-term and digitalized housing from three perspectives:

Housing market.

Co-living and LCT have high rents per square metre and returns. However, they are presented as an affordable alternative for a specific target audience. Based on this paradox, it is important to better understand the dynamic relationship between the emergence of these types of housing and the crisis of access to affordable housing in the long term.

Public actors.

If they tend to see these new forms of housing as a tool for attracting international talent, some voices advocate caution. It is indeed useful to better understand why, where and how these products are supported (or slowed down), and how this is reflected at the regulatory and strategic levels.

Residents.

Finally, it is essential to better understand the diversity of profiles of users of these housing units. The high residential mobility in these segments impacts the residential prospects of tenants and the anchoring of talents and their families in the long term in Luxembourg.

This note is designed as the starting point of a diversified multi-year research in order to contribute to the public debate on the recent emergence of this type of housing and its impact on the real estate market and housing conditions in Luxembourg.

A geographical segmentation of rents in the Grand Duchy of Luxembourg – update and deepening

The update of this analysis on the geography of rents in Luxembourg covers data from the period 2022-2024 and is based on hedonic modelling of advertised rents. Unlike the analysis carried out in 2021, single-family homes were included and furnished rentals were excluded.

The hedonic model estimates show that the advertised rent depends heavily on the intrinsic characteristics of the property being rented: its living space, its very nature (depending on whether it is a house, a duplex, a triplex, etc.), the presence of certain annexes (an additional bathroom, a garden, a balcony, a terrace, a garage or an outdoor parking space) and finally its energy performance class.