On Thursday 16 January 2025, Luxembourg's Minister of Finance, Gilles Roth, and the Director of the Direct Tax Administration, Jean-Paul Olinger, held a press conference entitled "Simplification of procedures and modernisation and digitalization of the Direct Tax Administration".

Minister Roth underlined the government's ambition to make life easier for citizens and businesses by, on the one hand, reducing their tax burden and, on the other hand, reducing the administrative burden with a tax administration that listens to taxpayers.

A new tax calculator on the website of the Ministry of Finance

The Minister recalled the adaptation of the personal income tax scale by four index brackets on 1 January 2024 and the entry into force of the "Entlaaschtungs-Pak" with an additional neutralisation of 2.5 index brackets on 1 January 2025. This is aimed at leading to substantial tax relief for all taxpayers.

In order to allow citizens to compare their 2024 tax situation with that of 2025, a tax calculator is available on the website of the Ministry of Finance, also accessible via the link www.manner-steieren.lu.

Accessibility, simplification and digitalisation

With the aim of being more accessible to citizens, the Direct Tax Administration has already launched its Contact Centre on 18 November 2024, an innovative service for rapid support and optimised monitoring of taxpayer requests. Full deployment will be completed by mid-2025.

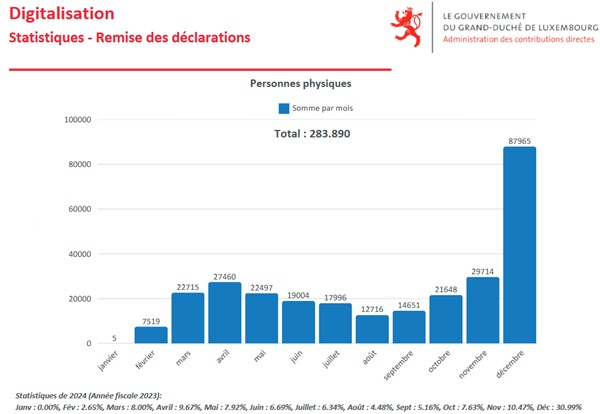

The Direct Tax Administration is also continuing to improve its MyGuichet electronic assistant to encourage more taxpayers to submit their tax returns online. The objective will be to achieve a rate of around 85% of returns filed electronically.

Finally, March 2025 marks the launch of the simple tax return for individuals. This is a tax return pre-filled by the administration in full compliance with the applicable data protection rules. While this optional offer (opt-in) is initially aimed at potentially 20,000 households with only “salary and pension” income (and in the absence of deductions outside the minimum flat rate), it will be gradually extended with the aim of covering 100,000 tax returns in 2028.

The digitalisation process will not stop there. It will concern the Direct Contributions Administration in its entirety to make it a more efficient administration: its internal functioning, the tax process, as well as interactions with other administrations.

Administrative simplification in the interest of citizens

"We are undertaking a major transformation to simplify our procedures, simplify the procedures for taxpayers and facilitate their interaction with our services. We are going to accelerate digitalisation to process simple files more quickly in order to better process complex files", declared Jean-Paul Olinger, the Director of the Direct Contributions Administration.

Minister Roth commented: "The transformation of the Direct Contributions Administration is not an end in itself. Like tax breaks, the objective must be to better serve the taxpayer and relieve them at the administrative level by exploiting the potential of new technologies. The pre-completed tax returns made available to citizens on a voluntary basis are fully in line with this approach of administrative simplification in the interest of citizens.”