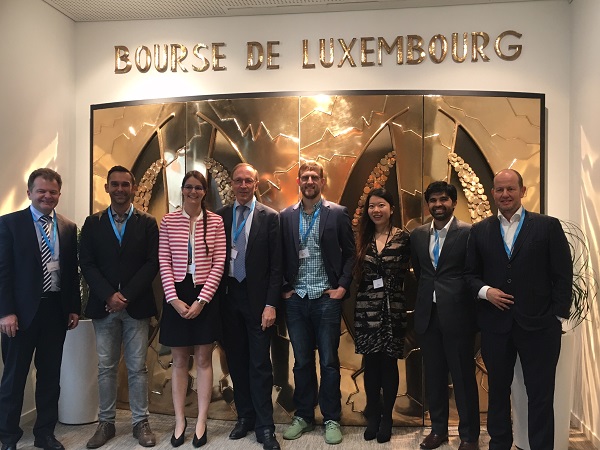

(L-R): Bernard Simon, CIO Luxembourg Stock Exchange; Nasir Zubairi, CEO LHoFT Foundation; Emilie Allaert, LHoFT Foundation; Robert Scharfe, CEO Luxembourg Stock Exchange; Brit Yonge, Co-Founder Lightyear; Lindsay Lin, Regulatory Counsel & Program Manager;

(L-R): Bernard Simon, CIO Luxembourg Stock Exchange; Nasir Zubairi, CEO LHoFT Foundation; Emilie Allaert, LHoFT Foundation; Robert Scharfe, CEO Luxembourg Stock Exchange; Brit Yonge, Co-Founder Lightyear; Lindsay Lin, Regulatory Counsel & Program Manager;

Are Initial Coin Offerings (ICOs) the Future of Fundraising or Just a Crypto ubble? This and many other questions were raised and discussed at a conference jointly organised by the LHoFT Foundation, the Luxembourg Stock Exchange (LuxSE) and the Stellar Development Foundation on 4 October 2017.

The Luxembourg House of Financial Technology Foundation (LHoFT) and the Stellar Development Foundation took the opportunity to present their white paper "Understanding Initial Coin Offerings: Technology, Benefits, Risks, and Regulations".

100 financial services executives participated in the debate in which seven speakers and panelists discussed the challenges ahead the ICO market as well as the importance for industry leaders and policymakers to understand the ICO economic and regulatory landscape, and its technical vocabulary.

Getting to know ICOs: what is in it for investors and regulators?

The 40-page paper sheds light on the ICO lifecycle, the benefits and risks of ICOs focusing on customer protection as a key challenge, potential legislative measures, policy considerations, best practices and recent global regulatory developments. The study also looks at strategic future paths for ICOs.

Lindsay Lin, Blockchain Counsel & Regulatory Affairs Manager at Stellar commented “The fundamental technologies underlying the ICO explosion — that is, distributed ledgers, smart contracts, consensus algorithms, and cryptography — have tremendous potential to transform network applications and usage, data integrity and security, authentication and identification, and trustless settlements. These technologies are here to stay. The key task for regulators is to create policies that reduce consumer and money laundering risks without impeding the adoption and development of these promising technologies.”

Emilie Allaert, Head of Operations at the LHoFT Foundation added “This white paper, created to help understand ICOs, is designed to be a foundation for the education we all have to pursue, particularly institutional and retail investors considering investing in ICOs. Consumer protection is not only achieved by the intervention of the authorities but also by educating potential investors on the risks and benefits of such investments.”

Managing ICOs in the context of financial regulation

Jean-Louis Schiltz, from Schiltz & Schiltz law firm, explained best practices in managing ICOs in the context of financial regulation. The discussions carried on during a panel debate on the opportunities and risks around ICOs. Nasir Zubairi, CEO of the LHoFT, discussed business and regulatory challenges to come with an expert panel comprising Bernard Simon, CIO of the Luxembourg Stock Exchange; Simon Toms, Partner at Allen & Overy; Javed Khattak, CFO of Humaniq and Jean-Louis Schiltz, from Schiltz & Schiltz. ICOs are clearly an area of focus today but the future remains unclear; the panel agreed that a form of ICO will continue to exist and will certainly be regulated.

Bernard Simon, CIO of the Luxembourg Stock Exchange said “ICOs have the potential to contribute to reshaping the future of financial services. However, to make the most of ICOs and the underlying technologies we need regulation to reduce related risks and protect investors.”