Development of UCIs in Luxembourg;

Credit: CSSF

Development of UCIs in Luxembourg;

Credit: CSSF

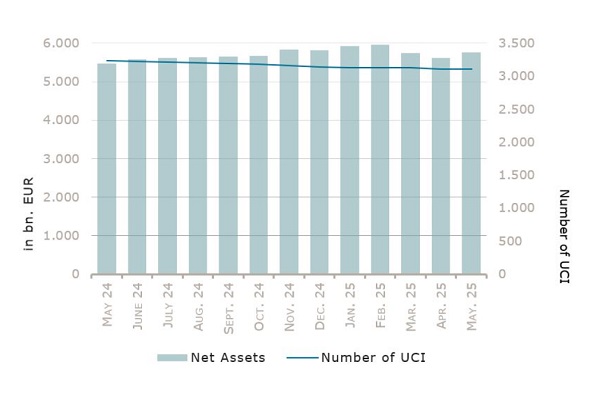

The Commission de Surveillance du Secteur Financier (CSSF) has reported that the total net assets of undertakings for collective investment (UCIs) in Luxembourg amounted to €5,765.403 billion (€5.77 trillion) as at 31 May 2025.

This represents an increase of 2.61% compared to €5,618.885 billion one month earlier. Over one year, the volume of net assets rose by 5.35%.

This monthly growth of €146.518 billion was attributed to positive net capital investments of €2.104 billion (0.04%) and the favourable development of financial markets amounting to €144.414 billion (2.57%).

The number of UCIs taken into consideration fell slightly to 3,107 (down from 3,112 in April). A total of 2,059 entities adopted an umbrella structure representing 12,380 sub-funds. Adding the 1,048 entities with a traditional UCI structure to that figure, a total of 13,428 fund units were active in Luxembourg's financial centre at the end of May.

Regarding financial market developments, the CSSF noted that global financial markets recorded strong gains in May, driven by improved US trade relations (tariffs). This de-escalation helped reduce fears of a global recession and supported a rebound in market sentiment favourable to risk assets. Equities also benefitted from supportive first-quarter corporate earnings, despite persistent uncertainty on the impact of tariffs on future earnings. In that context, all equity categories delivered robust monthly performances, led by the US equities category.

Equity UCI categories registered an overall positive capital investment with wide divergences across categories.

Moreover, bond markets benefited from the positive developments around US tariffs, leading to a tightening of credit spreads favourable to riskier bonds, notably high yield bonds. In the US, yields increased due to concerns over debt sustainability exacerbated by draft legislation that is expected to substantially increase the fiscal deficit while Moody's downgraded the US credit rating from AAA to Aa1. In contrast, yields in Europe remained largely unchanged. Against this backdrop, all fixed income categories delivered positive performances, except for the USD-denominated bonds category.

Also in May, fixed income UCIs registered an overall negative net capital investment mostly driven by outflows in the money market categories while most other categories recorded inflows.

During the month in question, six new UCIs were registered on the official list:

Undertakings for Collective Investment in Transferable Securities (UCITS) Part I 2010 Law: Berenberg Merger Arbitrage (Grevenmacher); Hamco SICAV (Luxembourg City); Mutuactivos International SICAV (Luxembourg City)

Undertakings for Collective Investment (UCIs) Part II 2010 Law: Bridgepoint Generations Master SCSP SICAV (Luxembourg City); Bridgepoint Generations SA SICAV (Luxembourg City)

Specialised Investment Funds (SIFs): CBRE Global Alpha Parallel Fund III FCP-SIF (Bertrange)

Conversely, eleven UCIs were removed from the official list:

UCITS Part I 2010 Law: LBBW Bond Select (Munsbach); UniNachhaltig Aktien Dividende (Senningerberg)

UCIs Part II 2010 Law: Ocean Fund (Luxembourg City); PGIM Private Real Estate (Luxembourg City)

SIFs: AM-RE SA SICAV-SIF (Luxembourg City); AXA Private Selection (Luxembourg City); Massena Capital Partners Luxembourg SCA / FIS (Luxembourg City); MUTB Non-Yen WGBI Yen-Hedged Index Fund (Luxembourg City); PATRIZIA Nordic Cities SCS SICAV-SIF (Luxembourg City); Redwing SA SICAV-SIF (Luxembourg City)

SICARs (Investment Company in Risk Capital): ResponsAbility BOP Investments SCA (Luxembourg)