Luigi Salerno, ALFI Head of Communications;

Credit: Steven Miller, Chronicle.lu

Luigi Salerno, ALFI Head of Communications;

Credit: Steven Miller, Chronicle.lu

On Wednesday 1 October 2025, the second day of the Association of the Luxembourg Fund Industry’s (ALFI) Private Assets Conference took place at Luxexpo The Box in Luxembourg-Kirchberg.

The two-day conference brought together fund professionals to discuss the latest market and regulatory developments with their peers and share best practices to lead their businesses to sustainable growth. During the second day of the event, the ALFI held a press conference in relation to the publication of the 2025 KPMG/ALFI Private Debt Survey.

The press conference began with an introduction from ALFI Head of Communications, Luigi Salerno, who welcomed the guest speakers and those in attendance and provided an overview of the topics which would be discussed.

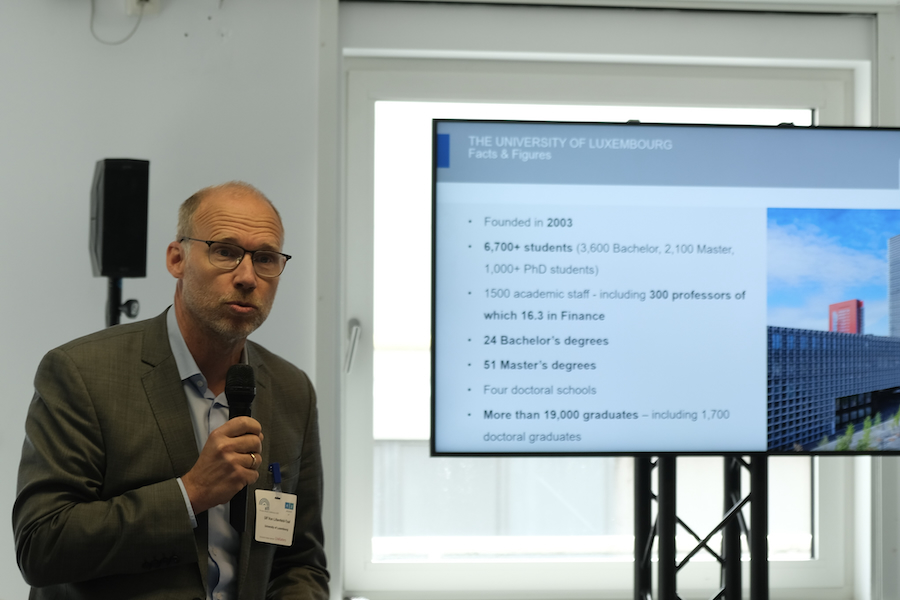

The first speaker, Ulf von Lilienfeld-Toal, full professor in Financial Economics at the University of Luxembourg, provided insight on the teaching programme on private assets developed by the Department of Finance at the University of Luxembourg, in collaboration with ALFI and Luxembourg’s Ministry of Finance. He explained how the programme was created due to Luxembourg’s role in the private assets industry and how private assets represent the future of the fund industry and the world of finance. He noted: “Luxembourg has an opportunity to climb the value chain and we need top research and top education to do this.” He added: “In terms of our vision, the idea is to grow leaders for the future out of Luxembourg.”

The conference’s second speaker, Patrick Augustin, Associate Professor of Finance at McGill University, spoke of the launch of the Master of Management in Finance (MMF) Luxembourg programme for professionals working in the financial sector and detailed how the curriculum - covering areas such as investment management, capital markets, pensions, funds and sustainable finance - has been tailored by the Canadian University to fit Luxembourg’s financial industry.

Mr Augustin then spoke on the subject of “Europe’s Productive Capital Gap” and provided data from a study undertaken in association with ALFI into the lack of risk capital that exists in pension funds across Europe. He emphasised the differences in countries with capitalised and non-capitalised pension schemes - those primarily operated on a pay-as-you-go basis - and highlighted the gaps in the amount of capital accumulation which have arisen between the two systems over the past 30 years, most notably in France and Germany where their primarily pay-as-you-go schemes hold two to three times less risk-bearing assets in comparison to the capitalised systems in countries such as Canada, Australia and Sweden.

Mr Augustin attributed this to the different approaches to pension reforms which have taken place in each country over the past 30 years. With regard to the impact of such differences, he noted: “That matters because the fact that this capital is missing limits the investment into R&D and innovation, into infrastructure, as well as into the US competitiveness. And that is part of the reason why we lag behind relative to economies like the US in terms of growth of the GDP.”

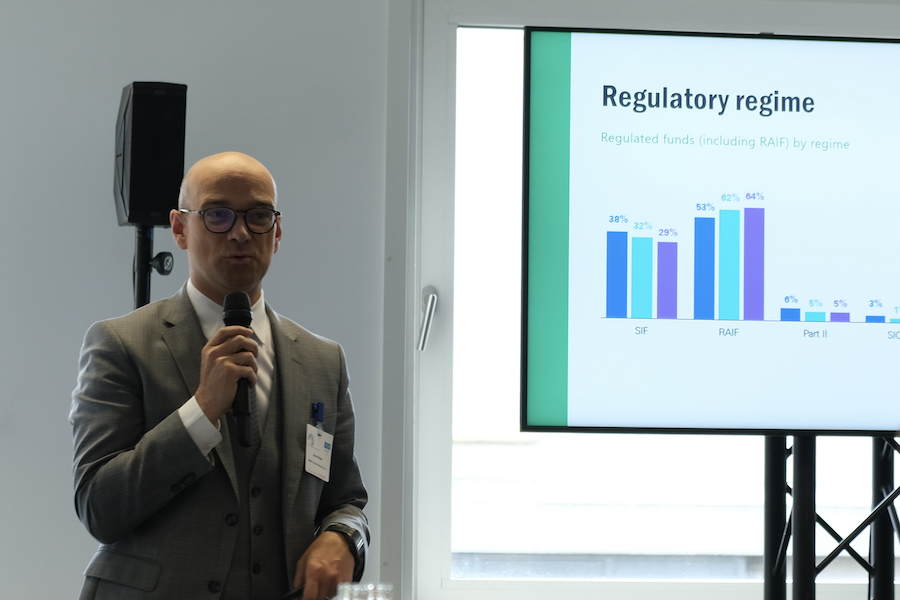

The final speaker, Julien Bieber, Partner, Tax, Alternative Investments at KPMG Luxembourg, spoke specifically on the 2025 KPMG/ALFI Private Debt Survey and provided an overview of the findings. Mr Bieber explained that the purpose of the study was to analyse the dynamics and trends of private debt funds in Luxembourg, anticipate future developments and provide qualitative, data-driven insights. In compiling the study, data was taken from thirteen depositary banks based in Luxembourg and covered more than 1,500 private debt funds and sub-funds.

Mr Bieber noted: “Private credit, private debt, I would say is the newest asset class and it is also the asset class where you have most of the growth nowadays and it is driven by the economic environment and some regulatory aspects.”

The survey noted that Luxembourg “continues to strengthen its position as a leading European hub for alternative credit strategies” and highlighted an average asset under management growth of 24.7% between 31 December 2023 and 31 December 2024, which “underscores the market’s sustained momentum”.