Credit: CSSF

Credit: CSSF

On Tuesday 30 September 2025, the Commission de Surveillance du Secteur Financier (CSSF) published its report on the profit and loss accounts of credit institutions in Luxembourg for the first six months of the year.

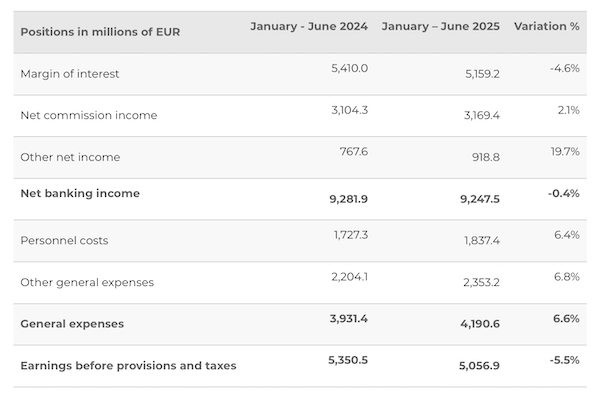

According to the CSSF, the profit before provisions and taxes of the Luxembourg banking sector amounted to €5,056.90 million for the first half of 2025, which represented a decrease of 5.5% compared to the same period of the previous year. Based on estimates, the CSSF calculated the evolution of earnings before provisions and taxes at -5% in annual comparison.

The CSSF also reported that in the first half of 2025, the interest margin fell by 4.6% compared to the same period in 2024. This downward trend, observed in 61% of banks, was attributed to the decrease in interest rates from the second half of 2024.

Net commission revenues increased by 2.1% year-on-year, an increase the CSSF said affected 68% of banks, especially custodian banks. The average value of the net assets of collective investment undertakings, which represented most of the calculation base for their asset custody commissions, grew by 6.5% in the first half of 2025 compared to the same period in 2024.

Other net income, including various items, very volatile in nature and generally non-recurring, increased by 19.7%.

With regard to personnel costs and other overheads, the CSSF said it should be noted that the magnitude of their growth, estimated at 6.4% and 6.8%, is greatly overestimated. The CSSF estimated that by correcting the gross figures from the reporting, the growth in personnel costs and other overhead costs is 3% and 2% respectively.

These developments lead to a cost-to-income ratio of 45.3% compared to 42.1% in 2024. As of 30 June 2025, among the 118 banks present in Luxembourg, fourteen reported a negative result.