Credit: CSSF

Credit: CSSF

The Commission de Surveillance du Secteur Financier (CSSF) has announced that the Luxembourg undertakings for collective investment (UCI) industry recorded a positive change amounting to €91.369 billion in December 2020.

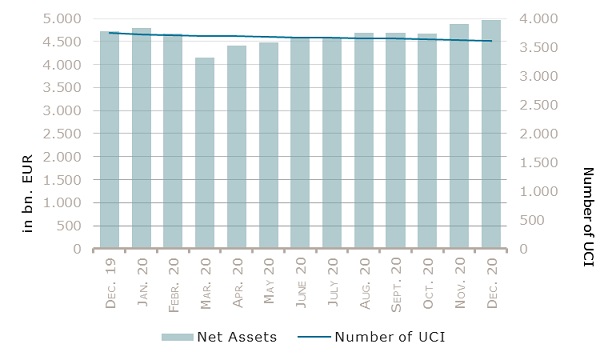

As at 31 December 2020, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs (investment companies in risk capital), amounted to €4,973.780 billion compared to €4,882.411 billion as at 30 November 2020, i.e. an increase of 1.87% over one month. Over the last twelve months, the volume of net assets rose by 5.40%.

The Luxembourg UCI industry thus registered a positive variation amounting to €91.369 billion in December. This increase represents the sum of positive net capital investments of €33.032 billion (up 0.68%) and of the positive development of financial markets amounting to €58.337 billion (up 1.19%).

The number of UCIs taken into consideration totalled 3,611, compared to 3,627 the previous month. A total of 2,377 entities adopted an umbrella structure representing 13,356 sub-funds. Adding the 1,234 entities with a traditional UCI structure to that figure, a total of 14,590 fund units were active in the financial centre.