Credit: Statec

Credit: Statec

On Monday 10 February, Luxembourg’s statistics institute, STATEC, published its updated inflation forecast along with an update on the national consumer price index.

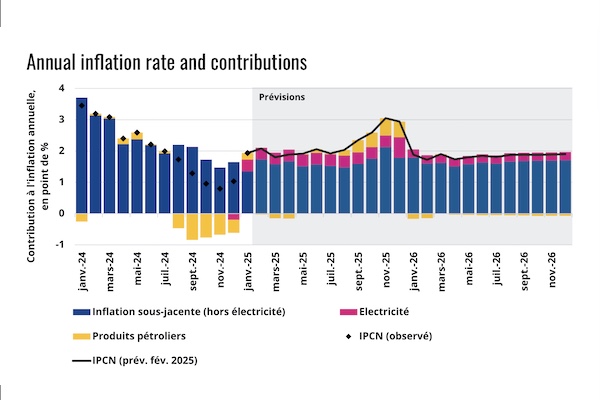

STATEC explained that with inflation rates falling below 1% in the last quarter of 2024, the slowdown in inflation in Luxembourg was stronger than expected. At the turn of 2025, however, the lifting of tariff shields led to an increase in gas and electricity prices, boosting annual inflation to a level close to 2% in January 2025. Following inflation of 2.1% in 2024, STATEC is forecasting inflation of 2.2% this year and 1.8% in 2026. The next indexations remain scheduled for the second quarter of 2025 and the second quarter of 2026.

After historically low levels in the final quarter of 2024, annual inflation rose to 1.9% in January 2025. This upward adjustment is primarily the result of the rise in the price of petroleum products (+4.4% year-on-year in January, compared with -8.1% in December 2024) coupled with core inflation which stood at +1.8% in January (compared with +1.5% a month earlier) as a result of the partial lifting of tariff shields.

In the last quarter of 2024, petroleum product prices fell by 12% and underlying inflation fell to 1.6% (compared with +4% a year earlier). While the slowdown in underlying inflation (excluding electricity) continued in January 2025, supported in particular by slower growth in services prices (+2.2% year-on-year in January, compared with +3% in December 2024), it was overshadowed by the rise in energy prices.

In January 2025, with the lifting of tariff shields, annual inflation in petroleum products will rise to 4.4% (with heating oil and gas prices increasing by 28% and 35% respectively in January compared with December 2024), while electricity prices will rise 24% (contributing 0.4 percentage points to overall inflation). Prices for non-energy industrial goods and food remained relatively stable in January, at +0.3% and +0.6% respectively over one year (compared with +0.5% each a month earlier).

For the eurozone as a whole, inflation rose to 2.5% according to a first estimate in January (compared with 2.4% in December 2024). While inflation in services and food fell (from +4% and +2.6% respectively in December 2024 to +3.9% and 2.3% in January), energy prices accelerated sharply in January (+1.8% year-on-year, compared with -6.1% a year earlier), reflecting in particular positive base effects linked to the weakness in energy prices at the start of 2024.

In the eurozone, the main international institutions expect inflation to average 2% in 2025 and 1.9% in 2026. For 2025, forecasts range from 1.9% (Oxford Economics) to 2.1% (European Commission, ECB and OECD). For 2026, inflation forecasts range from 1.7% (Oxford Economics) to 2% (IMF and OECD). The new projections from Oxford Economics (OE), used in STATEC's inflation forecasting model, highlight the uncertainties surrounding the re-election of Donald Trump as President of the United States and forecast a significant depreciation in the euro exchange rate against the $ to 1.04 $/€ in 2025 and 1.06 $/€ in 2026 (compared with 1.10 $/€ and 1.12 $/€ previously). The Brent crude oil price assumption remains unchanged at $ 73/barrel for 2025 and 2026, but the new exchange rates would increase the euro oil bill. OE's latest forecasts, on the other hand, anticipate a slower decline in core inflation in the eurozone, as well as more sustained momentum in food inflation in 2025. Energy inflation in the eurozone should also accelerate in the first quarter of 2025, reflecting expected base effects on energy prices.

In Luxembourg, government measures on energy prices introduced during 2022 and 2023 have kept inflation at a lower level than in the eurozone. The complete disappearance of measures on petroleum products on 31 December 2024 and the partial abolition of electricity price-cap measures (with the price increase limited to 30% compared with September 2022) would, however, result in an upward adjustment in energy prices in 2025, which should subside by 2026, in line with the fall in energy prices on international markets. However, market price expectations are volatile and the resulting forecasts for 2026 should be treated with caution.

Reflecting the rise in oil prices in euro terms, STATEC has revised its inflation forecast for this year to 2.2% (compared with 2.1% in December). Next year's inflation forecast remains unchanged at 1.8%. Core inflation, which includes electricity, is maintained at 2.1% in 2025 and revised slightly upwards to 2% in 2026 (compared with 1.9% previously). According to the inflation forecasts in the central scenario, indexation would still take place in the second quarter of 2025 and the second quarter of 2026.

STATEC also detailed two alternative energy pricing scenarios, which are based on historical deviations in electricity and gas tariffs and the price of Brent crude oil (the latter being reflected in the price of diesel, petrol and heating oil). Taking into account the measures in place (and in particular a fixed price for electricity in 2025), the high and low scenarios for electricity differ only for the year 2026. The high scenario assumes that in 2026, electricity, gas and Brent crude will rise by 32%, 1% and 13% respectively. The low scenario anticipates a smaller increase in the price of electricity (+5%) and a fall in the price of gas (-13%) and Brent (-21%) in 2026.

In all cases, the next indexation would take place in the second quarter of 2025. In the high scenario, the next indexation would take place in the fourth quarter of 2025, followed by another in the third quarter of 2026. The low scenario does not include any additional indexation between now and the end of 2026.

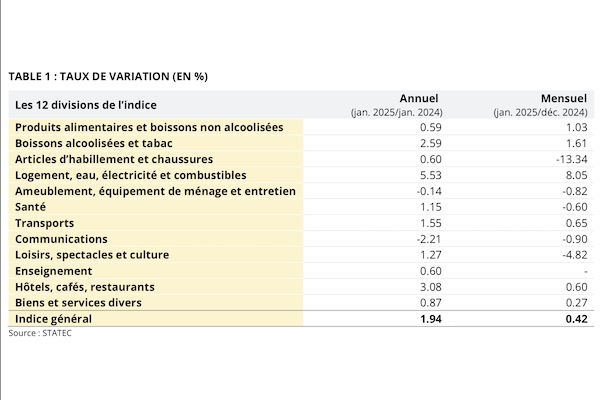

STATEC also reported that in January 2025 the national consumer price index showed a monthly increase of 0.4%. This was mainly due to the rebound in energy prices, following the end of tariff shields on energy prices at the beginning of 2025. After falling by 13.6% in December 2024, electricity prices rose by 43.9% in January. This corresponds to an increase of 24.6% compared with September 2022, the reference date for the introduction of the tariff shield.

The petroleum products aggregate rose by 14.5% on the previous month. This sharp rise is mainly due to the end of certain government subsidies and the increase in the CO2 tax from January 2025. Following the end of the €0.15 per litre rebate for heating oil, the bill climbed 28.0% on the previous month for households that had filled their oil tanks. Due to the end of state coverage of network costs (introduced in May 2022) and the increase in the CO2 tax, the cost of domestic gas is up 36.0%. The end of network cost coverage alone accounts for 34.5% of the increase in gas prices. At the pump, motorists have to pay 3.8% more for a full tank of petrol and 4.1% more for a litre of diesel. Compared with January last year, petroleum product prices are 4.4% higher.

SM