Annual inflation rate and contributions;

Credit: STATEC, forecast of 6 May 2024

Annual inflation rate and contributions;

Credit: STATEC, forecast of 6 May 2024

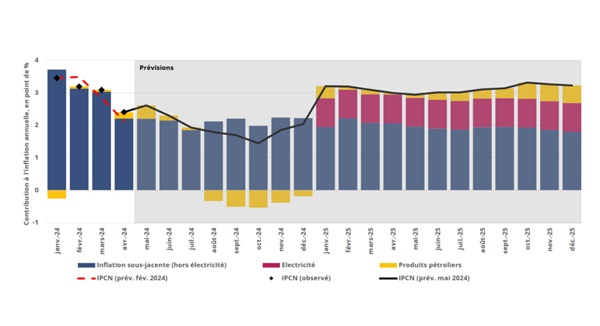

Luxembourg’s statistics institute, STATEC, has published a report in which it announced its Luxembourg inflation forecast of 2.3% in 2024 and 3.1% in 2025.

Geopolitical uncertainties in the Middle East have pushed up oil prices in recent months. As a result, petroleum products have made a positive contribution to inflation since January. STATEC therefore raised its inflation forecast for this year to 2.3%, and noted it anticipates a wage indexation in the final quarter of 2024. The supposed end of tariff shields at the turn of 2025 would lead to a rise in gas and electricity prices, pushing inflation up to 3.1%. A wage indexation is still planned for the third quarter of 2025.

In April 2024, annual inflation in Luxembourg reached its lowest level for almost three years, at 2.4%. This decline is the result of lower underlying inflation (2.4% in April compared to 4.9% a year ago). On the other hand, petroleum product prices have unexpectedly risen in recent months (up 3.5% over one year in April). Despite this, the slowdown in inflation observed over the recent period is very similar to that outlined in the forecasts published in February 2024, STATEC noted.

The slowdown in underlying inflation was due in particular to the slowdown in food prices after their peak in March, according to STATEC. In April, food inflation (up 2.4% over one year) made only a small contribution to overall inflation (up 0.3 percentage points, compared to up 1.6 percentage points a year earlier). Service prices slowed sharply in April (from up 4.7% year-on-year in March to up 3.4%). This reflects the end of the impact of indexation in February and April 2023. In fact, only the wage indexation in September 2023 still has an impact on annual inflation in April. Similar trends can be seen across the eurozone, where inflation fell sharply to 2.4% in April (compared to 7.0% a year earlier).

As indicated in the February 2024 STATNEWS, after the supposed lifting of the tariff shields, scheduled for 1 January 2025, and in the absence of new measures, inflation would rebound and remain above 3% throughout the next year. This would be mainly due to positive contributions from electricity and gas.

In 2025, inflation should approach 2% in the eurozone

The main international institutions are still expecting inflation in the eurozone to exceed 2% in 2024 and 2025. For 2024, forecasts range from 2.1% (Oxford Economics) to 2.7% (European Commission). For 2025, inflation is forecast at between 1.3% (Oxford Economics) and 2.2% (European Commission and OECD), STATEC added.

The new forecasts from Oxford Economics (OE) anticipate a slower decline in consumer prices than previously forecast. This is the result of more sustained momentum in food inflation and energy prices in 2024. The latest OE forecasts revise upwards the assumptions for the price of oil in 2024 to USD 83/barrel (compared with $76 previously), but maintain the price at $77/barrel in 2025. The euro/dollar exchange rate is maintained at 1.09 USD/EUR in 2024 and 1.10 USD/EUR in 2025. These revisions will bolster consumer price dynamics. OE has thus revised its inflation forecast for the eurozone to 2.1% in 2024 and 1.3% in 2025 (compared with 1.6% and 1.2% respectively previously).

Inflation 3% in Luxembourg with the supposed lifting of tariff shields

From January 2025, and in the absence of additional measures, consumer prices are expected to rise, particularly energy prices. As a result, STATEC expects gas and electricity prices to rise by 17% and 60% respectively by 2025. This forecast is a direct result of price trends on derivative markets and the way in which energy suppliers in Luxembourg are supplied. Market price expectations are volatile and the resulting forecasts for 2025 should therefore be treated with caution.

Reflecting the greater-than-expected slowdown in inflation towards the end of 2023 and the new EO assumptions, STATEC is raising its inflation forecast for this year slightly to 2.3% (from 2.2% previously). Next year, inflation is lowered to 3.1% (from 3.3% previously). Core inflation is revised down to 2.6% in 2024 (from 2.8% previously) and maintained at 3.0% in 2025. According to the inflation forecasts in the central scenario, a wage indexation would take place in the fourth quarter of 2024, with a further payment in the third quarter of 2025 (these dates were identical in last February's forecasts).

Two alternative energy price scenarios

Two alternative scenarios are based on historical deviations in electricity and gas tariffs and the price of Brent crude oil (the latter being reflected in the price of diesel, petrol and heating oil). Considering the measures in place, the high and low scenarios for electricity and gas are only taken into account for the year 2025. The “high” scenario assumes that, in 2025, gas, electricity and Brent crude will rise by 34%, 93% and 18% respectively. The “low” scenario anticipates a smaller increase in the price of gas (+11%) and electricity (+48%) and a fall in the price of Brent crude oil (-25%) in 2025.

The low scenario predicts that the next wage indexation will only take place in the second quarter of 2025. The high scenario anticipates indexation in the third quarter of 2024, followed by two further indexations in 2025: in the second and third quarters.