Orange: Unemployment rate (as a % of the active population); Blue: Domestic employment (annual variation in %);

Credit: STATEC

Orange: Unemployment rate (as a % of the active population); Blue: Domestic employment (annual variation in %);

Credit: STATEC

Luxembourg's statistical institute STATEC has published a report detailing the decline that the country’s economic activity has suffered in 2023.

Over the first two quarters of 2023, Luxembourg's real Gross Domestic Product (GDP) has seen a decline of approximately 1.7%. While this downturn is significant, it is even more pronounced in the financial sector, which recorded a 6% reduction in value added volume. This decline can be attributed to various factors, including reduced credit volumes to households and businesses, diminished net issues in investment funds and a drop in life insurance premiums, according to STATEC.

Despite these challenges, the financial sector has held up well in terms of value, thanks to favourable price effects linked to rising interest rates, STATEC noted. This resulted in a 65% increase in the interest margin of banks in the first half of 2023, according to data from the Commission de Surveillance du Secteur Financier (CSSF). Moreover, the sector's workforce has seen a nearly 4% year-on-year increase during the same period.

In addition to the financial sector, other branches of Luxembourg's economy have shown signs of slowing value added in volume. Three sectors, in particular, are experiencing challenges that have an impact on the workforce:

The transport sector has seen recovery in the eurozone, driven by increased freight and passenger transport. However, in Luxembourg, air freight has been on a declining trend since 2022. This decline has affected the sector's added value, and job creation has slowed considerably since the second quarter of 2023.

While Information and Communication Services (ICT) saw double-digit growth in Luxembourg in 2021 and 2022, the sector has stagnated in recent quarters, despite growth continuing in the eurozone. Employment in this sector in Luxembourg is growing at a slower pace in 2023 (+2.6% year-on-year in the first half of the year), compared to the eurozone (+4.1% over the same period).

Value added in volume for the construction sector has declined by approximately 6% year-on-year in the first half of 2023 in Luxembourg, in contrast to a 0.4% increase in the eurozone. This decline is more pronounced in residential construction, where real estate market indicators in Luxembourg have shown a relatively sharper turnaround compared to the rest of Europe. The construction workforce has been declining in Luxembourg since the start of the year and job seekers from this sector are contributing significantly to the rise in unemployment.

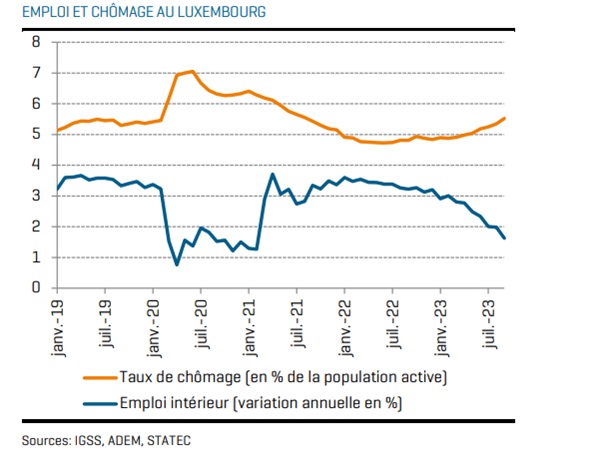

Unemployment in Luxembourg has been on an upward trajectory since the beginning of 2023. This is in stark contrast to the eurozone, where the unemployment rate has remained relatively stable. Luxembourg's annual employment increase of around 2.5% is necessary to stabilise unemployment, but this rate has not been achieved since the spring of 2023. The country's unemployment rate has continued to rise as it approaches the fourth quarter of the year.

Luxembourg's industrial production has experienced a significant decline in 2023, with a decrease of approximately 6% compared to the previous year. This places Luxembourg among the countries with the lowest industrial production results in the eurozone. Energy production and distribution have contributed significantly to this decline, along with machinery and equipment, the textile industry and the manufacturing of metal products.

The real estate market in Luxembourg has been adversely affected by reduced demand due to increasing borrowing costs. The number of housing transactions has declined by more than 10% year-on-year in the second quarter of 2023, with Luxembourg experiencing one of the most significant drops in Europe, second only to Finland. The decrease has particularly impacted apartment transactions under construction, which have seen a sharp 63% decrease.

The decline in demand has also led to a reduction in house prices, with Luxembourg showing one of the most substantial corrections compared to other European countries. It is indicative of a broader trend where food prices have been rising at a slower pace in the eurozone and Luxembourg, particularly in categories such as dairy products, meat, bread and cereals and vegetables.

Tax revenue in Luxembourg experienced a decline in the third quarter of 2023, with a 4.1% decrease compared to the previous quarter. This follows a period of growth in the first half of the year. Businesses' taxes saw a significant decrease, reflecting the overall slowdown in economic activity. On the household side, taxes withheld on capital income experienced a notable decline in the third quarter.