Credit: STATEC

Credit: STATEC

Luxembourg's statistical institute, STATEC, has updated its inflation forecasts for the beginning of August 2022 by integrating the impact of the recent runaway on the energy markets.

According to STATEC, the growing risks of gas shortages in Europe are driving up not only gas prices but also those of electricity and the gradual transmission of market prices to consumer prices exerts upward pressure on inflation, and the latter will intensify this fall, with several increases in the price of gas from October 2022 and an increase in the price of electricity in January 2023.

General price increases

Inflation in Luxembourg remained stable in August 2022 (6.8%) but should peak at 8.7% in January 2023. The steep pace of inflation is explained by the direct and indirect impact of the rise in energy prices on end consumer prices. The rise in uncertainty surrounding the supply of gas in Europe is transmitted to the price of electricity and, more generally, to the prices of a wide range of goods and services. The maintenance of the "Zero COVID" strategy in China also continues to disrupt global production chains, as well as persistent supply and demand imbalances, positively impacting the price of a large number of goods and services. In Europe, these pressures on prices are reinforced by the sanctions against the Russian invasion of Ukraine and the depreciation of the euro which makes imports more expensive.

Gazprom's recent decision to extend the closure of Nord Stream 1 indefinitely has heightened tensions on the gas market in Europe. In 2021, the average price of the Dutch TTF, which refers, was €45 per megawatt-hour (MWh). On 31 August 2022, the price was close to €240 per MWh, its most expensive daily average recorded up to that date. Bullish momentum is also seen in the derivatives markets where contracts for future deliveries are traded. The contracts exchanged during the month of August 2022 thus anticipate a gas price of €210 per MWh on average for 2023. In July 2022, the price anticipated for 2023 was still €140 per MWh.

These developments directly affect the price of electricity via the operation of the gross European market. On 1 January 2022, the price of electricity on the German market, with which the Luxembourg network is best connected, was €85 per MWh. After months of continuous increases, the €660 per MWh mark was crossed at the end of August. Future contracts for 2023 traded at €560 per MWh in August, against €350 per MWh in July.

Anticipated developments in energy markets

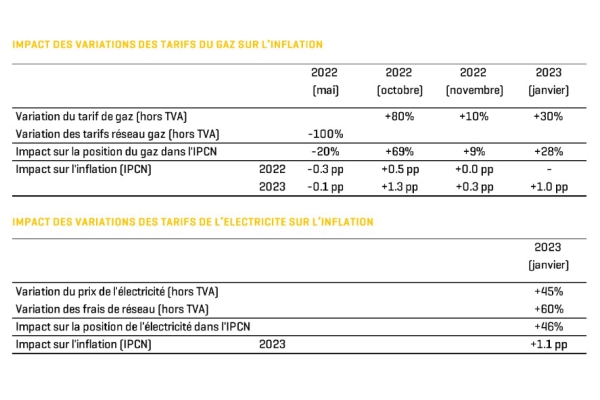

In order to take into account the developments of the last few weeks, the assumptions underlying the forecasts have been adapted. In the central scenario, the consumer price of gas in Luxembourg is assumed to increase during the next autumn-winter by 160% compared to summer 2022 (against 90% in the last forecasts). STATEC is still anticipating an 80% increase in the price of gas in October 2022, now followed by a 10% increase in November 2022 and then 30% in January 2023 (against 10% previously). Consumer prices for electricity are also adjusted, anticipating an increase of 45% in January 2023 (against 35% previously). Taking into account the values observed in August 2022, the price of Brent in 2022 is marginally revised downwards to $106 per barrel (against $107 per barrel previously) just like the price of the euro against the dollar depreciated to $1.06 per euro on annual average (against $1.07 per euro previously). The assumptions for 2023, taken from Oxford Economics forecasts, are not modified: the price of Brent is expected at $97 per barrel, and the exchange rate of the euro against the dollar at $1.06 per euro.

Impact of gas and electricity price increases on inflation

The above assumptions contribute up to 2% points to inflation in 2023. The impact would be even more pronounced if the gas network tariffs, for which an increase is expected in early 2023, were not borne by the state.

Inflation unchanged for 2022, new upward revision for 2023

According to the inflation forecasts of the central scenario, anticipatory inflation in 2022 is maintained at 6.6% for the national consumer price index (indice des prix à la consommation national - IPCN) and 4.3% for core inflation. The forecasts for 2023 are, however, revised upwards: 6.6% for the general inflation rate and 4.9% for underlying inflation (against respectively 5.3% and 4.5% previously). An index tranche would be triggered in the fourth quarter of 2022 and the subsequent tranches would be triggered in the first quarter of 2023 and in the third quarter of 2023. To this is added the payment of the index tranche triggered in June 2022, which will be made in April 2023, in accordance with the law of 29 June 2022 transposing certain measures provided for by the tripartite agreement of 31 March 2022.

On the bullish side, growing risks of gas shortages in Europe could weigh even more on the price of gas and electricity. The recent total shutdown of Nord Stream 1 will lead to a rise in the price of gas which could be accentuated if European countries fail in their efforts to coordinate supply. Furthermore, the gas price shock could have repercussions on the oil price via a substitution effect, which would further increase the energy bill in Luxembourg. The high scenario thus assumes a Brent price following an upward trend (based on deviations based on historical price volatility) and a price shock on gas during the next autumn-winter of almost 225% compared to summer 2022. This shock would be followed by a 50% increase in the price of electricity in January 2023 compared to December 2022.

On the downside, interventions in the energy market to limit price increases and the European Commission's emergency plan, which plans to reduce gas consumption in Europe by 15% until next spring, could mitigate the tensions on the supply and the price of gas. Consequently, the price of electricity would experience a smaller adjustment than forecast by the central scenario. In this context, the low scenario considers a downward trend in the price of Brent (from deviations based on the historical volatility of the price), an increase of almost 100% in the price of gas and 40% on the price of electricity.

The low scenario forecasts the next overrun of the maturity side only in the fourth quarter of 2022 and in the second quarter of 2023. The high scenario forecasts that a new trench would be triggered in the fourth quarter og 2022 triggering of index tranches in the first, second and third quarters of 2023. In accordance with the law of 29 June 2022, all scenarios include in April 2023 the application of the index tranche triggered in June 2022.

Other uncertainties that could impact inflation forecasts are not taken into account in this forecast. On the side of upside risks, the analysis does not take into account a possible accentuation of the depreciation of the euro against the dollar. This would further stimulate underlying inflation via more expensive import prices in Europe. In addition, tightness in the labour market could intensify and increase the risks of a price-wage loop (second-round effects), i.e. wages would increase faster than labour productivity, which would increase labour costs higher than production and prices being raised to compensate for the loss of margins, and therefore inflation would be reinforced. On the downside, a relaxation of the "Zero COVID" strategy in China could reduce tensions in supply chains and slow inflation. Finally, an acceleration in the normalisation of monetary policy in Europe could slow inflation as well.