Real GDP;

Credit: STATEC

Real GDP;

Credit: STATEC

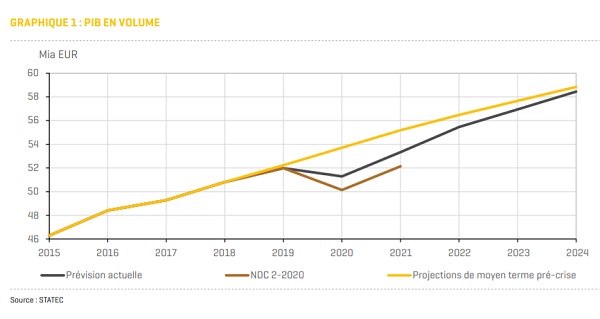

Based on the first statistical estimate of the quarterly national accounts, STATEC has revised upwards growth in Luxembourg in 2020 to -1.3%.

For 2021, STATEC expected real growth to rebound to 4%, confirming its December forecast. Due to the great uncertainty about the evolution of the pandemic, an optimistic scenario and a pessimistic scenario support these forecasts.

STATEC has drawn up its central forecast scenario for 2024 on the basis of a dynamic recovery in the euro zone's GDP: the latter could increase by 4.2% in 2021 and 4.9% in 2022. Economic activity is expected to restart for good in the middle of 2021, although the first two quarters would still be marked by containment measures depending on the country. These should become less strict as people at risk are vaccinated and the arrival of better weather slows the progression of the virus. By 2023/24, activity in the euro zone is expected to slow again, bringing growth to the trend rate of 1-1.5% per year.

For Luxembourg, these assumptions would translate into real GDP growth of 4% in 2021 and 2022, before also slowing down to 2.5-3% in the medium term. The financial sector could benefit in the very short term from the rebound in activity and the relative dynamism of the financial markets. The other market branches would gradually take over, while the public sector would see its spending slow down in 2021, but its cyclical impact would remain broadly neutral. The labour market is expected to suffer in 2021 from the aftermath of the crisis and job creation is not expected to recover substantially until 2022 (up 2.8% for total employment, compared to 1.7% in 2021). Over the entire period, job creations would not be able to absorb new (net) entries into the market, so the unemployment rate would rise to 7% by the end of the horizon, only dropping temporarily in 2022.

In Luxembourg, the rise in consumer prices is expected to be around 1.7% in 2021, supported by the recovery in oil prices while overall inflationary trends should remain contained. In the medium term, the latter is expected to be stimulated by a new index tranche in 2022 and by the economic recovery, gradually raising inflation to 2%.

Two extreme scenarios

Oxford Economics, on which STATEC bases its assumptions concerning the international environment, has developed two alternative scenarios, alongside the central scenario described above, which remains the most probable.

In the optimistic scenario, the restrictions on certain sectors with strong physical interaction would start to be lifted from the second quarter of 2021. In this case, the euro zone's GDP would rebound by around 8% in 2021 instead of 4.3% in the central scenario. For Luxembourg, this would translate into an improvement in the economy, bringing the increase in real GDP to 7.0% and that of employment to 2.5%.

At the other extreme, if the pandemic continues, with new, more dangerous mutations of the virus appearing spontaneously and randomly, the restrictions could apply throughout 2021, activity could fall in the euro zone (down 1% over the whole of 2021). This would result in a slight drop in activity in the Grand Duchy of around 0.5%, a virtual stagnation of employment and a greater rise in unemployment.

Oxford Economics has endowed the two alternative scenarios with probabilities of realisation (determined in December 2020): 15% for the negative scenario and 30% for the positive scenario. According to STATEC, these probabilities evolve in the light of the most recent developments and it is impossible to place with precision the future trajectories of the international and Luxembourgish economy between the two extremes. The economic situation remains highly uncertain, depending on the health situation. While the start of the vaccination campaign has long been seen as a turning point, the emergence of new variants is likely to be a game-changer.