Credit: Statec; Eurostat

Credit: Statec; Eurostat

In a recent report on the Luxembourg and Eurozone economies, Statec revealed a 4% increase in car sales in the Grand Duchy.

In the first quarter of 2019, new car registrations were up 4.0% year-on-year in Luxembourg. This result significantly differs from that of the euro zone, where sales fell by 3.9% over the same period. Almost all other Member States saw car sales decrease compared to the beginning of 2018, with the exception of Germany (+0.2%). This could be attributed to a certain standardisation in Luxembourg that does not yet exist in the euro area.

Regarding light and heavy commercial vehicles, registrations recorded a growth of 4.5% year-on-year in the first quarter in the euro area - and almost 20% in Luxembourg.

Moreover, 2018 saw the main revenues of Luxembourg banks increase each quarter despite historically low interest rates and falling stock markets at the end of the year. Compared to 2017, interest margin increased by 2.2% and net fee income by 4.9%. According to the CSSF, the increase in the interest margin is due to volume growth and, for a limited number of banks, the application of negative interest rates on deposits of institutional clients. Keeping interest rates at the lowest levels, however, continues to pose real challenges for nearly half of the banks that have seen their interest margin decrease.

Overhead costs also continued to grow strongly (by around 10% compared to 2017), thus erasing the banks' gains on their main revenues and stagnating the gross value added of the banking sector in 2018 (+0.7% on the value-added data, down 0.3% by volume).

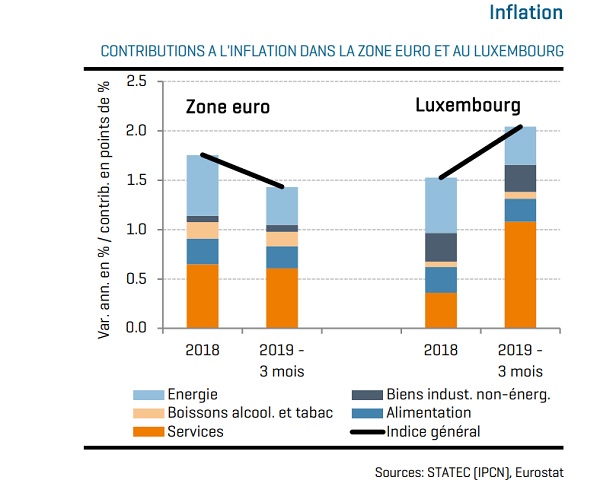

In addition, while inflation in Luxembourg was below that of the euro area in 2018, it became significantly higher in early 2019. In March, the gap between inflation in the Grand Duchy (2.2% on year) and in the euro zone (1.4%) reached its highest level since the end of 2015. This is partly explained by the slow increase in travel prices in some European countries in March (temporarily hampered by the different timing of the Easter holidays compared to 2018).

After a moderate increase in the price of services in Luxembourg in 2018, notably as a result of the impact of the services reform, inflation rose to 2.4% over one year in March 2019. At the beginning of the year, the contribution of services to inflation thus tripled in the Grand Duchy compared to 2018 while it remained stable in the euro zone. Non-energy industrial goods also contributed to inflation. On the other hand, increases in the price of alcoholic beverages and tobacco remained considerably lower in Luxembourg.

Overall, the euro zone showed signs of improvement in a difficult context, according to the Statec report. Despite the downward revision of euro area growth by international institutions (for the European Commission, the OECD and the IMF, the expected growth for 2019 averages 1.2%, compared to an increase of 1.8% in the autumn forecast), economic surveys have also showed some signs of improvement, especially with prospects for Germany and for the euro zone recovering from January to April. The report similarly commented that despite disrupting French economic activity since last November, the "yellow vests" movement led to government concessions to promote the purchasing power of households, a development that can be expected to have positive short-term benefits, according to INSEE.