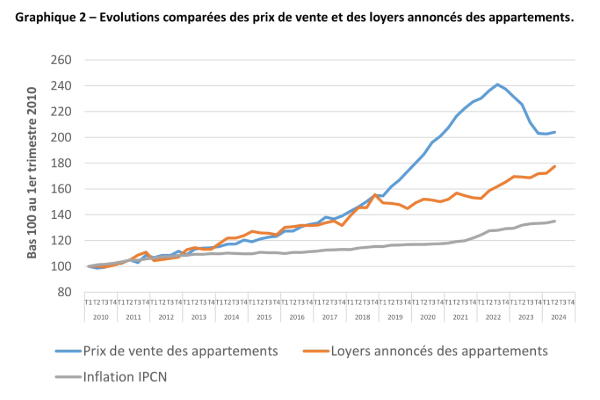

Comparative developments of sale prices and rentals of apartments 2010 to 2024;

Credit: Ministry of Housing and Spatial Planning

Comparative developments of sale prices and rentals of apartments 2010 to 2024;

Credit: Ministry of Housing and Spatial Planning

On Tuesday 4 February 2025, Luxembourg’s Housing Observatory published two reports on the rental market in Luxembourg.

The analysis, communicated by Luxembourg’s Ministry of Housing and Spatial Planning, consists of two reports. Analysis Report 13 studies the estimates of the rate of return on a property investment in Luxembourg, whilst Analysis Report 14 focuses on the challenges and steps taken to set up a rental register in Luxembourg.

Recent work by the Housing Observatory highlighted the existence of cycles on the residential real estate market in Luxembourg, although the ranges and durations may have differed over time. Four episodes of price increases have been identified since 1975, contributing to the current level of housing prices. The most recent episode was observed between 2010 and 2021.

Analysis Report 13 details that it is difficult to explain the sharp acceleration in housing price growth between 2018 and 2022 simply by attributing the interplay of supply and demand, since the economic fundamentals have not changed significantly compared to previous years. However, it put forward several hypotheses, a combination of which may have amplified the demand for housing.

One of the most feasible hypotheses reported is based on a strong appetite from “traditional” investors (active for a long time in Luxembourg) for the residential real estate market, in the absence of high returns on alternative investments and uncertainties within the office market after 2020.

This implies the demand for housing on the purchase/sale market is driven both by the housing needs of households looking for a new main residence (whether they are households already domiciled in Luxembourg or new arrivals), but also by landlords who identify investment opportunities in residential investment.

The report concluded that the calculation of a net rate of return on investment in rental housing should include the following elements:

- the gross rental yield rate;

- the cost of financing the loan;

- the prospect of capital gains;

- the taxation of the investment (excluding the sale of the property).

The theoretical estimate made in the report does not take into account the total duration of ownership of the property, but is simply a projection of the profitability of the investment for the coming year. However, this theoretical estimate is said to explain the lack of interest of investors in investing in rental housing in 2024. This is reinforced by the rise in interest rates which has made certain alternative investments (for example, bonds) relatively more interesting.

Asking what would then be the conditions for a return of rental investors to the market, the report posits a return of "confidence", suggesting both confidence in the market (which would require a lasting stabilisation of prices and rates) and a return of confidence in projects and actors (in particular for the acquisition of housing in VEFA from developers) would be required.

Analysis Report 14, looking at the challenges and steps for the establishment of a rental register in Luxembourg, details how the German rental market is made relatively transparent by the obligation for municipalities with more than 50,000 inhabitants to produce a Mietspiegel (Rent Index).

The analysis report first presents the legal framework, as well as the operation and steps required to establish the Mietspiegel according to German federal legislation. Indeed, the objective of the German rent index is to reflect the level of rents practiced in different districts of a municipality (or an agglomeration of) by differentiating housing on the basis of quality criteria (surface area, age, level of equipment, ecological performance) and their geographical location (qualities of the urban location).

The report also presents the necessary steps for the possible implementation of a rental register in Luxembourg. In addition to the development of a legal basis, the establishment of a register can be divided into several phases:

1. Preparation of the general framework of the project and methodological approaches;

2. Identification and selection of actors capable of developing the tool itself;

3. Survey to collect raw data;

4. Assessment of data quality and plausibility;

5. Validation and publication of the rental register.

Given that the establishment of a rental register likely requires a legal basis other than that provided for in Article 28 of the Law of 21 September 2006 on residential leases, a minimum period of four years should be provided for, where appropriate, before having a validated rental register.

The establishment of a rental register remains independent of a revision of the rent ceiling. The purpose of a rental register is as an observation tool which provides a better understanding of the level of rents charged according to the different yet related characteristics. Its usefulness therefore goes beyond possible regulation of rents, referring to a general level of rents.

SM