Industrial production;

Credit: STATEC

Industrial production;

Credit: STATEC

STATEC recently published a report about industrial production in Luxembourg and the eurozone.

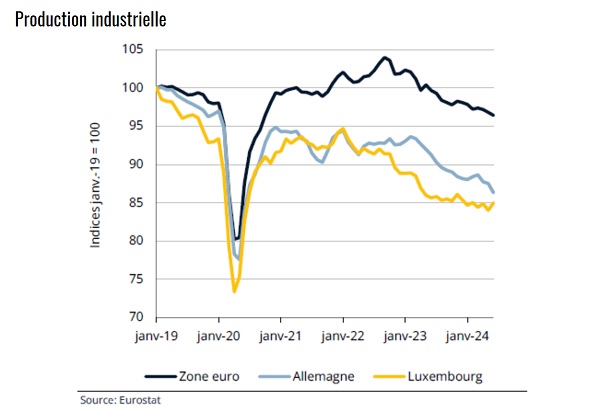

According to this report, industrial production is continuing its downward trend. The business surveys of the third quarter of 2024 have not painted a hopeful picture for short-term recovery.

Industrial production in the eurozone continued to decline at the start of summer. This fell by 0.3% over one month in July and showed a decrease of almost 4% over the first seven months of 2024 compared to last year. This negative trend is relatively generalised between the different Member States, with the exception of some in southern Europe such as Spain (+0.1% over the first seven months), Portugal (+0.6%) and Greece (+7.3%). Among the others, Germany (-5.2%) and Austria (-4.0%) stood out as the most affected. Luxembourg showed a less pronounced decline than in the eurozone in general (-2.9%), but this follows an already mediocre 2023, during which production fell by 5.6%, compared to only 2.1% in the eurozone.

For the eurozone as a whole, the decline in production was most evident on the side of capital goods and durable consumer goods. STATEC attributed this among other things to the deterioration in results observed in the manufacture of machinery and equipment and in the automobile industry. Furthermore, the decline in activity in construction is not unrelated to the declines in production observed in the extractive industries, the manufacture of cement, bricks and tiles and certain metal and glass products, noted STATEC. Generally speaking, most types of production have been suffering a setback this year. Among the rare exceptions are products that are not very sensitive to the economic cycle, such as those in shipbuilding, those linked to rail transport and those in aeronautics and space construction, as well as those from the manufacture of weapons and munitions.

Nevertheless, employment in industry in the eurozone continued to grow over the whole of the first half of 2024 (+0.4% over one year), even if it tends to slow down (after an increase of 0.9% in 2023). The increase in the workforce in the first half of 2024 was largely due to Spain and Italy; the trend in the other countries tipped rather towards a decline (-1.5% over one year in Luxembourg) or at best stagnation. Given the decline in production recorded this year and the gloomy outlook heading into the fourth quarter, STATEC warned a downward adjustment in industrial employment in the euro area is to be feared thereafter.

Moreover, the signals sent by the business surveys in industry over the summer period did not suggest any short-term improvement at the euro area level.

In Luxembourg, the industrial confidence indicator had reached a low point in June 2023 and has recovered slightly since then (which coincided with a still present but less pronounced deterioration in industrial production). However, over the most recent months, it showed a lot of volatility (a sharp drop in July, a sharp rise in September), particularly in terms of production development prospects (particularly for players in metallurgy and metal products). Over the whole of the third quarter, it was slightly down compared to the previous quarter, also reflecting a less favourable situation.

In the second quarter of this year, the workforce in construction continued to decline at a rate comparable to that of the two previous quarters (down 1.6% or 760 employees over one quarter). While the decline was less pronounced than in previous quarters for construction (-2.8% over one quarter) and civil engineering (-0.1%), the downward trend has accelerated further for specialised construction work (-1.0%) in the first and second quarters of 2024. Employment had still increased slightly in the first half of 2023, while that of construction as a whole was already down. These specialised works contribute (-340 people in Q2) to almost half of the decline in construction.

In specialised finishing work, net declines in the workforce of 8% over one year were recorded for painting work (i.e. -220 employees over one year in Q2) and tiling (-110). The number of jobs fell by 6% over one year for carpentry work (-220 employees) and plastering work (-50).

Housing sales prices, which had only shown a slight decline in the first quarter (-0.7% over one quarter), increased by 1% in the second quarter of 2024. STATEC said this increase - a first since the decline that began at the end of 2022 - was mainly driven by apartment sales. STATEC added that it seems likely that real estate prices (in total) have passed their low point and will continue to increase in the coming quarters. However, they remained well below their level of a year ago (-8.3%) and the peak reached in the third quarter of 2022 (-15.5%).

The number of real estate transactions, which had already increased at the beginning of 2024, is continuing on this trend. In addition to the decline in real estate prices, the decline in fixed mortgage rates is believed to be favouring this recovery. Over one year, the number of transactions increased by 26%, driven by sales of existing homes. The number of transactions of new apartments, despite a slight increase, remains lower in the second quarter than a year ago.

Rates on real estate loans in Luxembourg, which peaked at the end of 2023, continue to fall. In July 2024, the average fixed rate was 3.7% (-0.3 percentage points over one year) and the variable rate was 4.5% (-0.2 percentage points). Fixed rates follow long-term market rates and have already been easing since the beginning of 2024 thanks to expectations of monetary easing, while variable rates adjust mainly when key rates are changed. STATEC reported that this spread in rates supports demand for fixed-rate loans, which accounted for 65% of new mortgage loans granted in July. Rates on consumer loans fell at the beginning of the year and have since stabilised, while for term deposits, the decline in rates has only been observed since June.

STATEC added that the rebound that began in the first quarter of 2024 has been confirmed for the Luxembourg financial sector. In the second quarter, added value increased by 3.1% over one quarter in value and by 0.2% in volume. Financial companies benefited from the rise in assets and income from investment funds as well as life insurance premiums. Net assets of mutual funds increased by 7% year-on-year in the second quarter, driven by valuations and the rebound in net issues. Life insurance premiums increased by 35% over the same period, mainly thanks to products with guaranteed returns.

Growth in bank results (+25% year-on-year in Q2 alone) was supported by the increase in fees on wealth management and investment funds and by a decline in personnel and operating costs. Interest margins increased by only 2% year-on-year (after ten quarters of double-digit increases), with high interest rates trending downward. Fund management companies also benefited from the growth in fees, but the restructuring of the activities of some large companies weighed on the overall result, noted STATEC.

Overall, consumer prices for telecommunications have continued to fall in recent years (-9% in the eurozone between 2015 and 2023). While some eurozone countries, including Belgium, Portugal and Spain, have seen price increases over this period, Luxembourg has seen a decline close to the average, with a -12%. The decline in prices has been most pronounced in the Netherlands (-27%), Italy (-23%) and Austria (-19%). However, these marked differences between countries seem to be partly due to methodological differences in taking into account quality changes. STATEC clarified that it is mainly equipment which has become cheaper (-34% between 2017 and 2023), but the prices of telephone services have also fallen (-2%).

In Luxembourg, the prices of mobile telephone equipment have fallen the most (-39% between 2015 and 2023), followed by internet access providers (-24%) and fixed telephone equipment (-18%). The index for mobile telephone services, on the other hand, rose slightly (+2% over the entire period), as did the index for fixed telecommunications services (+6%). However, these developments have had little impact on the overall price index, given that communications are relatively lightly weighted, representing only 2% of average household expenditure in 2023 (after a peak of 3% in 2015).

Regarding wages, in the eurozone, as in France and Germany, the average wage cost (AWC) continues to slow down gradually. In the second quarter of 2024, it increased by 4.4% in the eurozone, which is still well above the long-term average growth (close to 2.5%). In Luxembourg and Belgium, the AWC slowed down much more markedly in the first half of 2024, as a result of the sharp increases linked to the automatic indexation systems in 2023.

In Luxembourg, the impact of indexation on the growth of the AWC was 5.9% points in the first quarter of 2024, compared to only 2.5 points in the second quarter, since only the September index bracket still affects the annual evolution of the AWC. Furthermore, the reduction in employer contributions to offset the costs related to this last tranche is slowing down the growth of the CSM. From a sectoral point of view, it is mainly the transport and storage sector that is contributing to the slowdown in the average wage cost, due to a base effect.

On the subject of energy, STATEC noted that, after two years of energy crisis, which led to a drop in gas and electricity consumption in 2022 and 2023, 2024 marks a turning point. Over the first eight months of the year, these consumptions rebounded, recording an increase of more than 3% compared to the same period in 2023.

The recovery in gas consumption is attributable to industry, where consumption jumped by 14% over the first eight months of the year. It thus more than offset the drop in heating consumption (-2%), linked in particular to a decline of around 5% in heating degree days this year compared to 2023. On the electricity side, the increase was partly due to the rise in electric vehicles, new registrations of which increased by more than 20% over the first eight months of the year. However, consumption dynamics may be slowed in 2025 due to the expected increase in the consumer price of electricity of 30%.