Credit: ILR

Credit: ILR

On Monday 2 September 2024, the Luxembourg Regulatory Institute (ILR) published a statistical report on postal services in Luxembourg in 2023.

According to the report, parcel services, closely linked to e-commerce, are recording constant and sustained growth. The price increase in mail services in September 2022 has allowed a rebound in turnover, while the downward trend in the volume handled has been confirmed.

In 2023, the ILR introduced new indicators to refine the monitoring and analysis of the Luxembourg postal services market, in particular the segmentation of the parcel services market.

The report covers the key figures for the postal services market for 2023 and their evolution since 2020. The document is based on data collected from 34 providers active on the Luxembourg postal services market in 2023, including a new provider active on the mail services market.

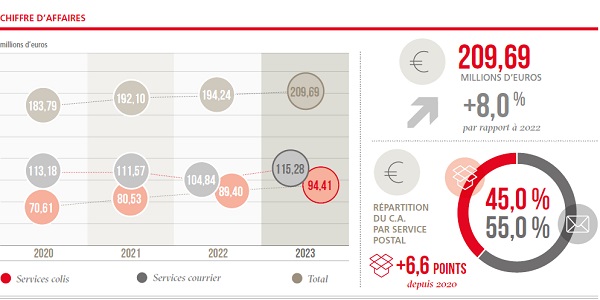

The turnover of the postal services market reached €209.69 million in 2023, up 8% compared to 2022. This is divided between the turnover of mail services amounting to €115.28 million (+10%) and that of parcel services totalling €94.41 million (+5.6%). The share of parcel services turnover fell to 45% of the total postal sector in 2023, down 1 point. The share of parcel services volume amounted to 12.3%, up 1.7 points.

The average revenue of service providers per parcel followed a downward trend, going from €12.63 to €11.46 between 2022 and 2023, while the average revenue per letter followed an upward trend, going from €0.77 to €0.88.

Mail services represented 131.41 million units, down 6.0% compared to 2022. However, turnover increased by 10% in 2023, due to the price increase in September 2022. National traffic, which represents 78.1% of total traffic, recorded a decline of -1% compared to 2022. Mail traffic showed a continuous decline with a compound annual rate of -5.5% between 2020 and 2023. The designated universal service provider, POST Luxembourg, handled 97.5% of total mail traffic.

Parcel services totalled 18.36 million units, up 10.9% compared to 2022. The growth of the parcel services market is mainly supported by the growth of inbound cross-border traffic, which recorded a net increase of 12.2% with a volume of 14.85 million parcels. The Business-to-Business (B2B) segment counted sixteen service providers and the Business-to-Consumer (B2C) segment had fifteen, of which eleven are active in both segments.

Moreover, the statistical survey showed that subcontracting plays an important role in the postal services market, with almost 80% of total parcel traffic subcontracted to third-party service providers. Subcontracting mainly affects the cross-border parcel services market. According to the data collected, fifteen service providers indicated that they use subcontractors, of which thirteen are active in parcel services.

The postal sector employed close to 2,000 people in 2023. POST Luxembourg alone employed more than 1,200 people, representing 63% of jobs in the sector.

Regarding access to postal services, 99 POST Luxembourg points of sale and 102 points of sale of ten other providers are established on Luxembourg territory. The number of POST Luxembourg automatic distribution points (Pack up) increased to 141 in 2023 (+24 since 2020).