Credit: BIL

Credit: BIL

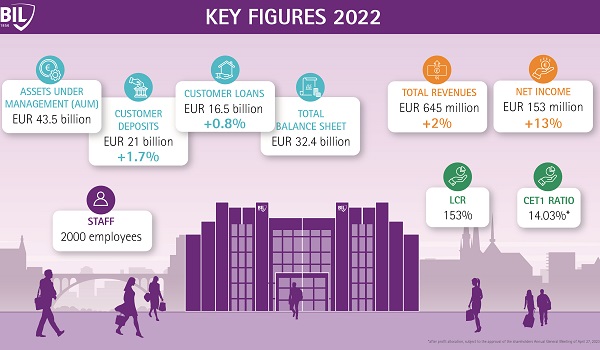

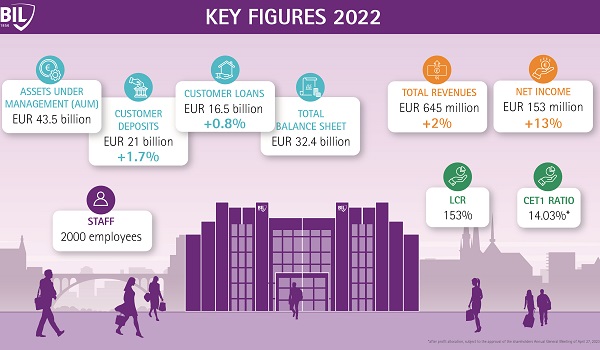

Banque Internationale à Luxembourg (BIL) has announced its full-year financial results for 2022; the bank reported a net income of €153 million.

After two years marked by the COVID-19 pandemic and the resulting recessionary shock, the strong economic rebound and the return of inflation in 2021, last year - maked by Russia's invasion of Ukraine - proved no less challenging. According to BIL, this radical change of macroeconomic environment significantly impacted Europe, although Luxembourg's economy proved its resilience once again.

To support the economy, BIL joined the Luxembourg Government's loan guarantee scheme intended for Luxembourgish companies experiencing difficulties due the substantial rise in commodity and energy prices caused by the conflict in Ukraine. The bank also stayed on course on the roll out of its transformative five-year strategic plan, "Energise Create Together 2025". In 2022, BIL focused on supporting its clients in its key commercial markets, expanding its sustainable product and service offering and accelerating its bank-wide project, the implementation of its new core banking system.

At €43.5 billion, BIL's assets under management (AUM) marked a slight decrease in 2022 compared to 2021. The bank made efforts to limit the impact of the negative market effect (attributed to the sharp decline on equity markets) by increasing net new assets under management.

Customer deposits increased by 1.7% to €21 billion, whilst customer loans increased by 0.8% to €16.5 billion. This limited growth, according to BIL, is linked to a general slowdown in mortgage loan production in Luxembourg, due to the rise in interest rates, delays in new construction projects caused by the rising cost of raw materials and supply chain stress as a result of the Russia-Ukraine conflict.

This commercial performance translated into total revenues of €645 million, up by 2% in 2022 and up by 8% excluding non-recurring items. The bank's commercial activities limited to core operating revenues stood at €589 million, compared with €548 million at year-end 2021.

Expenses amounted to €460 million, up by 4% compared with 2021. According to BIL, recruitment and higher labour costs contributed to an increase in overall staff expenses. In addition, general expenses were impacted by higher energy costs and renewed business travel. The bank noted, however, that it had actively managed its loan portfolio, significantly improving the quality of its assets which allowed it to reduce the cost of risk, from €38 million in 2021 to €19 million in 2022.

BIL reported a net income after tax of €153 million, up by 13% over one year.

In 2023, BIL expected that uncertainties surrounding the global economy would remain high but assured that it would continue to focus on the sound management of its activities, governed by its risk management framework. It will focus on finalising its new core banking system, while ensuring its commercial targets are met. The bank will also pursue its journey towards more sustainability.

Marcel Leyers, CEO of BIL, commented: "These are strong results in a context of shocks and transformation. They confirm the relevance of our strategic choices and of our comprehensive and loyal response to the needs of all our clients, be they individuals, entrepreneurs and businesses. This performance was made possible thanks to the dedication of our teams. We have now started 2023 with determination, a year of transition in many respects."

BIL will publish its 2022 financial report on 27 April 2023 following the shareholders' annual general meeting (AGM).

Credit: BIL

Credit: BIL