Credit: LISER

Credit: LISER

Luxembourg's Housing Observatory (Observatoire de l’habitat) recently published Note 31 on the situation of different types of households on the housing market, in collaboration with national statistics agency STATEC.

In this report, the housing affordability ratio was calculated, as the ratio between the cost of housing (rent charges or loan repayments as well as the normal household costs such as electricity or water, etc.) and a household’s disposable income (excluding housing aids), which is an indicator of the ability to access and remain in housing according to Luxembourg Institute of Socio-Economic Research (LISER).

In 2019, 32% of households living in Luxembourg were composed of single persons and 29.6% were couples without children. Couples with children made up almost a quarter of all resident households (24.5%). The single-parent households represented 4.3% of all households and most of them are headed by a woman.

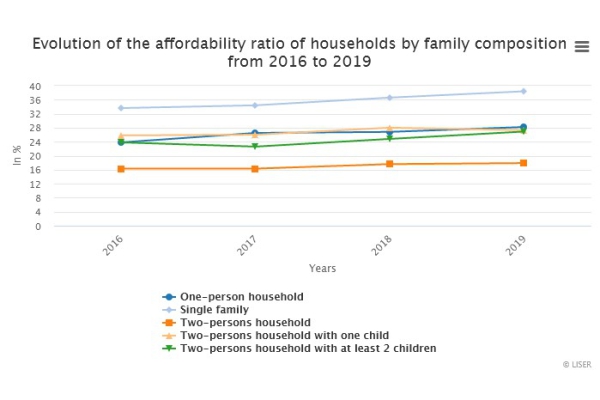

For any particular year, single-parent households had the highest affordability ratio for their dwelling and with an increase of 14.1% in three years, the report found. Indeed, starting from 33.6% in 2016, their affordability rate is 38.4% in 2019. On the other hand, for all other types of households, affordability ratio never exceeded 30%, although they get closer toward 2019. Thus, the lowest rates are observed among couples without children (less than 18% over the period), and it increased by less than 10% between 2016 and 2019. The levels of affordability ratio of single people and couples with children are quite close over the entire period, between 23% and 28%. Nevertheless, their evolution is quite different. The affordability ratio grew less rapidly among couples with one child (up 6.1% between 2016 and 2019) compared to couples with at least two children (up 13%) and single people (up 18.8%).

Concerning the total cost of housing, single-parent households have been paying more than €1,200 per month on average since 2017. This total amount is one of the highest compared to other households and only other families with children have a higher cost of housing. Moreover, housing costs have increased faster (up 17.3% between 2016 and 2019) for these single-parent households, except couples without children (up 19.4%). In comparison, these costs increased by 9.4% and 13.6% respectively among families with only one child and those with at least two children.

At the same time, single-parent households have one of the lowest averages of disposable income and only single-adult households appear to be less well-off than them. In addition, this income has not increased as much as other households: up 6.2% between 2016 and 2019, against up 6.9% for single people, up 12.4% for couples without children or up 11.3% for couples with one child.

Thus, combining high total housing costs, which increased more sharply compared to other families, and low disposable income on average - which also grew less rapidly than that of other households, single-parent households appeared to be the most vulnerable on the housing market, the study concludes.

Finally, the study also found correlation between household composition and the housing tenure status, which also vary vastly from one category of household to another. Thus, whatever the year, the share of tenants renting at market price or owner-occupied with a mortgage loan is the highest among households with children (couples or single-parent households): 79% or more in 2019 against 54.7% among single people or 45.9% for couples without children. Nevertheless, the main difference between single-parent households and couples with children is the share of tenants that is much higher for the first group. In 2019, 37.9% of single-parent households are tenants renting at market price and 41.1% are owner-occupied with a mortgage loan. Among couples with at least two children, for example, less than 20% are tenants renting at market price and 65.3% are owner-occupied with a mortgage loan. This large share of tenants renting at market price among single-parent households justifies once more the high affordability rate for these families.

The full report is available online via https://logement.public.lu/fr/publications/observatoire/note-31.html.