Credit: PwC

Credit: PwC

PwC Luxembourg has released the first edition of its ESG Mutual Funds Poster showcasing the environmental, social and governance (ESG) funds growth trends for the first half of 2021.

The report revealed Luxembourg as the top destination for European Union (EU)-domiciled ESG Mutual Funds in the first half of the year.

By requiring all financial market participants to disclose information regarding the integration of ESG factors into their investment processes, the Sustainable Finance Disclosure Regulation (SFDR) represents one of the most transformational regulatory developments in European financial landscape.

PwC expects ESG Mutual Funds assets to climb between €5.4 trillion and €7.6 trillion by 2025, making up between 41% and 57% of total EU-domiciled Mutual Fund assets under management (AuM).

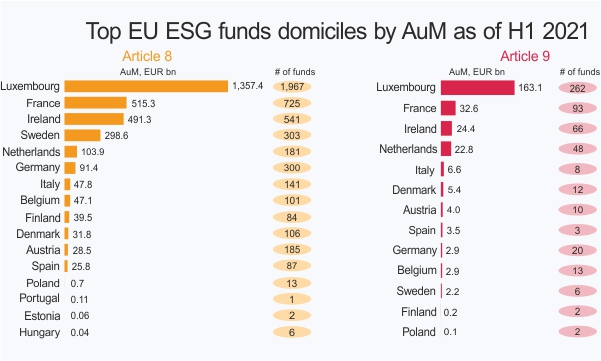

The semi-annual update show Luxembourg to top the EU-domiciled ESG assets AuM both under article 8 and article 9 as of the first half (H1) of 2021.

The report also showed the top 20 Asset Managers by AuM and number of funds, ranked first for both by Amundi under article 9 and ranked first by Pictet by AuM and Candriam by number of funds under article 9.

The total EU-domiciled ESG exchange traded fund (ETF) value surpassed €125 billion as of H1 2021.