According to a report by EY Consulting, and promoted by the Société des Auteurs, Compositeurs et Éditeurs de Musique (Society of Authors, Composers, and Editors of Music, SACEM), the cultural and creative economy across the EU lost approximately 31% of its revenues in 2020.

After a first report published with GESAC in 2014, EY Consulting took up the challenge of producing a second edition at the end of a dramatic year for the cultural and creative industries (CCIs), both in Europe and around the world.

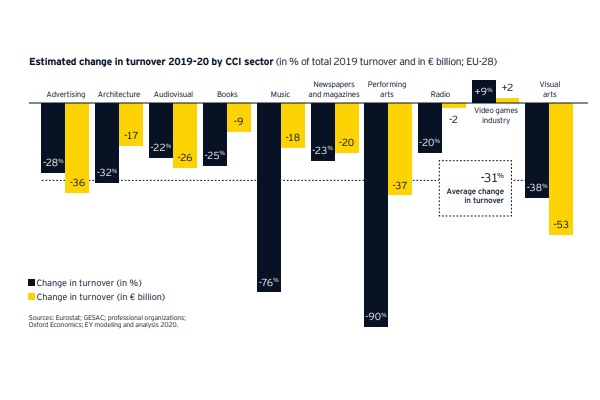

The total turnover of CCIs in the EU28 is reduced to €444 billion in 2020, a net drop of €199 billion from 2019. With a loss of 31% of its turnover, the cultural and creative economy is one of the most affected in Europe, slightly less than air transport but more than the tourism and automotive industries (-27% and -25% respectively).

The shockwaves of COVID-19 are felt in all CCIs: performing arts (-90% between 2019 and 2020) and music (-76%) are the most impacted; visual arts, architecture, advertising, books, press and AV activities fell by 20% to 40% compared with 2019. The video games industry seems to be the only one to hold up (+9%).

The crisis has hit Central and Eastern Europe the hardest (from -36% in Lithuania to -44% in Bulgaria and Estonia).

All sectors are affected: even those that seemed to be protected by home consumption faced a sharp drop in income, given the central role of physical experiences and sales in their business models, as well as uncontrollable production and distribution costs.

Before COVID-19

At the end of 2019, the cultural and creative economy was a European heavyweight. With a turnover of €643 billion and a total added value of €253 billion in 2019, the core activities of the cultural and creative industries (CCIs) represented 4.4% of EU GDP in terms of total turnover.

Therefore, the economic contribution of CCIs is greater than that of telecommunications, high technology, pharmaceuticals or the automotive industry.

Since 2013, total CCI revenues have increased by €93 billion and by almost 17%. At the end of 2019, CCIs employed more than 7.6 million people in the EU-28, and they have added approximately 700,000 (+10%) jobs, including authors, performers and other creative workers, since 2013.

Market Evolution / Innovation

Digital experiences and online/offline distribution combinations have fueled the growth, but the market continues to evolve. In the last six years, the turnover generated by online cultural content, services and works grew by 11.5% per year.

Cultural enterprises have historically been one of the first to experiment and adopt digital technologies (digital photos, digital carriers such as DVD and

Blu-ray, CDs, shooting digitally, streaming, virtual reality and online platforms). Cultural content has fueled the growth and the development of the internet from the very beginning, and still represent a high share of broadband consumption.

Since 2013, CCI companies and organisations have invested heavily in innovation and digitisation, both from a business perspective and in terms of production and customer experience.

After COVID-19: How to Rebuild Europe

As a result of in-depth research and interviews conducted by EY teams, and based on the opinions of experts and organizations representing the CCIs, the following challenges have been identified as priorities for the recovery and growth of the creative economy:

- Challenge 1 – Finance: Provide massive public funding and promote private investment in cultural and creative businesses, organisations, entrepreneurs and

creators – two indispensable levers to support and accelerate their recovery and transformation.

- Challenge 2 – Empower: Promote the EU's diversified cultural offering by ensuring a solid legal framework to allow for the development of private investment in production and distribution, providing the necessary conditions for an adequate return on investment for businesses and guaranteeing appropriate income for creators.

- Challenge 3 – Leverage: Use the CCIs – and the multiplied power of their millions of individual and collective talents – as a major accelerator of social, societal and environmental transitions in Europe.

Scope of the study

This study covers the 10 core cultural and creative sectors that have already served as the scope of the first report on CCIs in Europe, published in 2014 by

EY and GESAC: Advertising, Architecture, Audiovisual, Books, Music, Newspapers and magazines, Performing arts, Radio, Video games and Visual arts.

The geographical scope of the study is the European Union (EU) and the United Kingdom (UK), known as the EU-28. Unless otherwise stated, all references to the EU in this study refer to the scope of the EU-28.