Development of UCIs in Luxembourg;

Credit: CSSF

Development of UCIs in Luxembourg;

Credit: CSSF

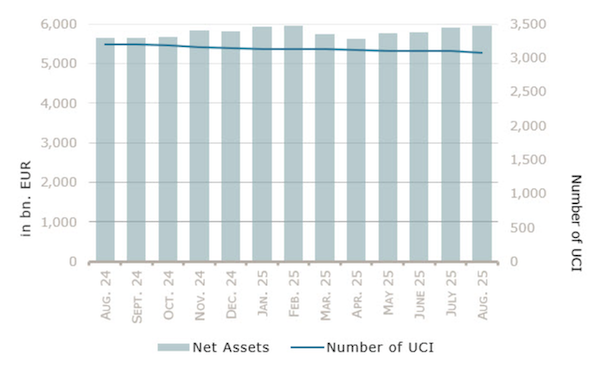

The Commission de Surveillance du Secteur Financier (CSSF) has reported that as of 31 August 2025, the total net assets of undertakings for collective investment (UCIs) in Luxembourg stood at €5,950.291 billion (€5.95 trillion).

This marked an increase of 0.75% compared to the previous month’s €5,906.147 billion. Over the past twelve months, net assets have grown by 5.52%. The monthly growth of €44.144 billion was attributed to positive net capital investments of €47.160 billion (0.80%) and the negative development of financial markets amounting to €3.016 billion (-0.05%).

The total number of UCIs slightly decreased to 3,079 (down from 3,096 in July). Of these, 2,054 entities used an umbrella structure representing 12,330 sub-funds. Adding the 1,025 entities with a traditional UCI structure brings the total number of active fund units in Luxembourg’s financial centre to 13,355.

According to the CSSF, financial market developments in August were shaped by a shift in US Federal Reserve policy, with increased focus on the labour market rather than inflation, following data pointing to a weakening US jobs market. This raised expectations of interest rate cuts, despite robust economic growth and high inflation. Other notable developments included a US appeals court ruling declaring reciprocal tariffs illegal (with enforcement delayed pending appeal), and renewed political pressures on Fed matters.

Against this backdrop, US equities posted limited losses, with a nearly 2% adverse currency effect. European equities were unchanged, affected by expectations of a possible fall of the French government in September. Latin American equities rebounded strongly after July losses, with gains in Brazil driven by slowing inflation. Japanese equities registered substantial gains on positive economic data.

Equity UCI categories recorded overall positive capital investment, with the strongest inflows in Other, Eastern European and Japanese equities, although Latin American equities faced significant outflows. In bond markets, US yields declined, particularly at the short end of the curve, on expectations of rate cuts, while European yields were broadly stable except in France where political uncertainty pushed them up. Most fixed income categories posted modest negative monthly losses due to currency effects, but overall fixed income UCIs registered positive net capital investment, except for USD-denominated bonds which saw marginal outflows.

During August, twelve new UCIs were registered on the official list:

Undertakings for Collective Investment in Transferable Securities (UCITS) Part I 2010 Law: Deka-Infrastruktur Aktien (Senningerberg); HQAM SICAV (Munsbach); Munich Re Investment Partners Funds SICAV (Munsbach); Premium Selection UCITS SICAV (Luxembourg City); PTAM SICAV (Munsbach); Unieurorenta Unternehmensanleihen 2029 III (Senningerberg); Unieurorenta Unternehmensanleihen 2031 II (Senningerberg).

Undertakings for Collective Investment (UCIs) Part II 2010 Law: Blackstone Private Markets Solutions SCA-SICAV (Luxembourg City); Dawson (Lux) SA SICAV–UCI Part II (Howald); Deutsche Bank Private Markets SICAV (Leudelange); Eurazeo Prime (Luxembourg City).

Specialised Investment Funds (SIFs): Contino Fonds - FIS (Strassen).

Conversely, twenty-nine UCIs were removed from the official list:

UCITS Part I 2010 Law: Asian Bond Opportunities UI (Grevenmacher); Blackstar Multiple Opportunities (Strassen); Franklin Templeton Alternative Funds (Luxembourg City); Promont (Munsbach); Uniabsoluterertrag (Senningerberg); Unianlagemix: Konservativ (Senningerberg); Uniem Fernost (Senningerberg); Unieurorenta Real Zins (Senningerberg); Unifavorit: Aktien Europa (Senningerberg); Unirenta Corporates (Senningerberg); Unireserve (Senningerberg); Unireserve: Euro-Corporates (Senningerberg); Univaluefonds: Europa (Senningerberg); VAM Funds (Luxembourg City); VAM Managed Funds (Luxembourg City).

SIFs: Antin Infrastructure Partners II SICAV-SIF (Luxembourg City); AXA IM Mezzoalto (Luxembourg City); European Finance Opportunities SCA. SICAV-SIF (Capellen); Evergreen SICAV-FIS (Luxembourg City); Foresight Group SCA SICAV-SIF (Luxembourg City); Impact Finance Fund (Luxembourg City); Le Mans Fonds SCS, SICAV-FIS (Grevenmacher); Nuveen Alternative Investment Funds SICAV-SIF (Luxembourg City); Shere Lux - SICAF-SIF (Luxembourg City); Tectum SA, SICAV-FIS (Luxembourg City); UBP Dedicated SICAV-SIF (Luxembourg City).

SICARs: BWPE - FTL SCA, SICAR (Luxembourg City); Capman Lynx SCA, SICAR (Luxembourg City); Catalyst Romania SCA, SICAR (Senningerberg).