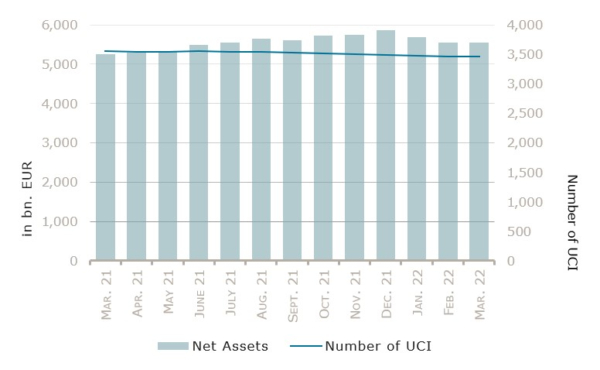

On Friday 29 April 2022, the Commission de Surveillance du Secteur Finance (CSSF), Luxembourg's financial regulator, confirmed that, as at 31 March 2022, the total net assets under management by entities in the Grand Duchy amounted to €5,57.342 billion compared to €5,545.049 billion as at 28 February 2022, i.e. an increase of 0.22% over one month; over the last twelve months, the volume of net assets rose by 5.87%.

The Luxembourg undertakings for collective investment (UCI) industry thus registered a positive variation amounting to €12.293 billion in March 2022. This increase represents the sum of negative net capital investments of €14.871 billion (down 0.27%) and of the positive development of financial markets amounting to €27.164 billion (up 0.49%).

The number of UCIs taken into consideration totalled 3,459, against 3,465 the previous month. A total of 2,266 entities adopted an umbrella structure representing 13,234 sub-funds. Adding the 1,193 entities with a traditional UCI structure to that figure, a total of 14,427 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of March.

Despite the development of the Ukraine crisis, the volatility of commodity markets, the persistence of inflation concerns and the increasingly stricter monetary policy stances, the UCI equity categories of developed markets recovered and recorded a positive performance, while bond yields continued to rise.

Concerning developed markets, the European equity UCI category registered a positive performance, the PMI business survey exceeding expectations and the geopolitical risks being partly priced out despite Europe recording a deceleration in activity, a dropdown in consumer confidence and high inflation. The US equity UCI category rose in March amid an overall stable US global economic picture with well oriented economic indicators, US labour market and growth continuing to look robust while inflation anticipations remain elevated. The appreciation of the USD against the EUR strengthened the gains. Japanese equity markets followed the upward market trend but, due to the sharp depreciation of more than 4% of the YEN against the EUR, the Japanese equity UCI category finished the month in negative territory.

As for emerging countries, the Asian equity UCI category realised a negative performance, mainly driven by Chinese equity markets on grounds of new lockdowns due to the pandemic in some major cities, the slowdown in the property market and regulatory actions in some sectors. The Eastern European equity UCI category overall declined given the continuation of the Ukraine conflict and the effects of related sanctions, although some equity markets in Eastern Europe such as Poland and Czech Republic registered a recovery. The Latin American equity UCI continued to enjoy strong gains supported by higher commodity prices and the strengthening of domestic currencies.

In March, the equity UCI categories registered a negative net capital investment, mainly driven by outflows in the European equity UCI category.