Credit: STATEC

Credit: STATEC

In its latest publication, STATEC has analysed the potential impact of the new CO2 tax, set to be introduced in Luxembourg on 1 January 2021.

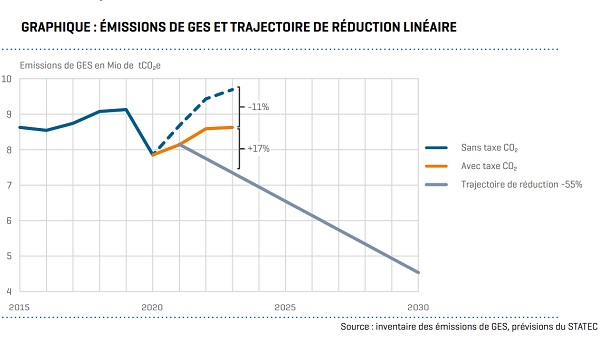

STATEC quantified the impact of this tax, the amount of which would gradually increase in 2022 and 2023. The report estimated that greenhouse gas emissions would drop by 11% compared to a situation without the tax, but compared to 2020 would rebound by 10% in 2023. The impact on tax revenue would be negative in the medium term and the impact on households with a low standard of living would be neutral. Business spending would be affected in a differentiated manner across industries, but economic activity as a whole would be little affected.

The CO2 tax will mainly cover fuels, fuel oil and gas. For 2021, the carbon price has been set at €20 per tonne of CO2, to increase by €5 respectively in 2022 and 2023. This translates into an additional cost, including VAT, of 6 cents per litre of diesel in 2021 and 9 cents in 2023. These amounts would make it possible to neutralise the recent drop in oil prices due to the pandemic. The impact on inflation would be around 0.4% in 2021 but the increase will not be taken into account for the calculation of wage indexation.

Following the rise in fossil fuel prices, it is expected that economic agents would adjust their demand downwards. Fuel sales should drop by 8% in 2021 and by as much as 15% by 2023, mainly following a decrease in diesel sales to non-residents. Petrol and heating oil consumption is expected to drop between 2% in 2021 and 4% in 2023 compared to a situation without CO2 tax. The tax would thus reduce greenhouse gas emissions by 6% in 2021 and by 11% by 2023, given that the transmission is progressive and that the amount of the tax increases over time.

It is generally accepted that the CO2 tax is a necessary condition, but not sufficient to reduce emissions. Other instruments (subsidies, bonus-malus systems, strengthening of energy standards) would also make it possible to reduce emissions. There also fundamental trends, such as the electrification of mobility and teleworking - for which STATEC plans to develop a more in-depth study in the future.

In addition, the report suggested that the rise in inflation would not be offset by the automatic wage indexation system, but households would benefit from an additional tax credit. The impact on low-income households would thus be neutralised and the tax incidence would be progressive, meaning that the impact of the tax will increase with the standard of living. Businesses would avoid a second round increase in their costs (via automatic indexation), but would bear the direct cost of the CO2 tax. The impact on economic activities would nevertheless be limited, particularly because service activities will be little affected.

Based on STATEC's forecasts on the consumption of petroleum products, the state should collect over €140 million in CO2 tax next year. The net impact on public revenues would nevertheless be less for three reasons: the drop in the volumes of petroleum products and the related tax revenues; lower volumes of tobacco and related tax revenues; the cost of social compensation measures, particularly the increase in tax credits. The impact on public revenues would thus be neutral in 2021 but would become negative in the medium term.