The start of 2020 will see fuel tax increase in Luxembourg, according to the Ministries of Finance, of Energy and Regional Planning and of Labour, Employment and Social and Solidarity Economy.

Pursuant to the Paris Agreement on climate change and detailed EU framework legislation, carbon emissions are accounted for in the country where the fuel is sold. Consequently, the Luxembourg state believes it will achieve its climate and energy objectives only by targeted measures in the field of the sale of road fuels, and more particularly the export of fuel by lorries in transit.

Since diesel and petrol prices in Luxembourg are well below those of neighbouring countries, it is considered essential to gradually reduce the price differences with those countries in order to reduce fuel exports.

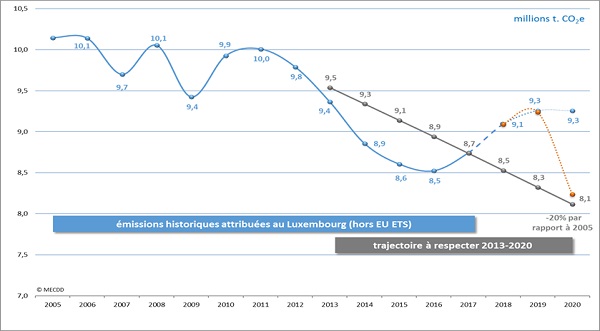

The respective ministries have recalled that the current development of fuel sales still jeopardises the achievement of Luxembourg's objectives in terms of CO2 reduction and energy efficiency by 2020. Admittedly, the increase in excise duties effected on 1 May 2019 has made it possible to stop the very pronounced upward trend observed since 2017. In fact, over the last seven months, sales have declined slightly compared to the same period of 2018 ( down 1.1% in total; up 5.3% for petrol, down 2.5% for diesel).

However, this adjustment has so far not caused a fall in absolute terms of the level of sales. In view of the high sales during the first four months of the year (up 11.3% compared to the first four months of 2018), it is almost certain that sales for the year 2019 will be at the highest level since 2012.

An interdepartmental committee (Finance, Environment, Energy, Economy) monitors and analyses the development of fuel sales and the impact of the measures taken by the government. With a view to achieving the climate objectives, the committee defines measures aimed at continuously reducing the impact of fuel sales on Luxembourg's CO2 balance, in accordance with the coalition agreement and regularly proposes adaptation measures to the government. Faced with current trends in the sale of road fuels, the committee decided that the government should increase the excise duties on road fuel, ie between 1 and 3 cents for petrol and between 3 and 5 cents for diesel. The entry into force of this increase will take place between February and April 2020.

The budgetary income from this increase in excise duties will be used to support measures for the energy transition and measures promoting social equity.

In addition, when public transport becomes free in March 2020, users will be encouraged to reduce the use of their private vehicle. Nevertheless, the government has recognised that some people cannot use public transport. Consequently, the current system of flat-rate deduction of an employee's travel costs between his/her home and his/her workplace will remain in force. In addition, the government has reaffirmed its will to continue to invest massively in public transport infrastructure.