Credit: CSSF

Credit: CSSF

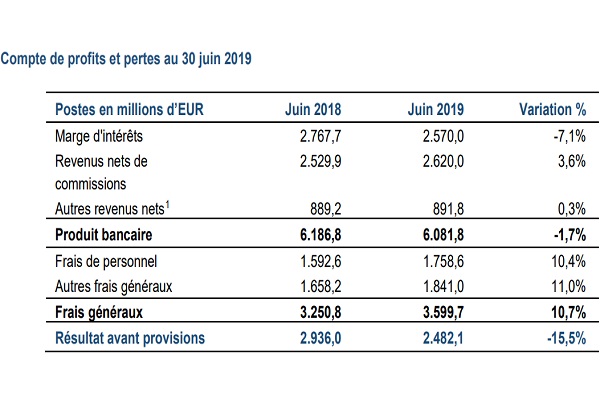

The Commission de Surveillance du Secteur Financier (CSSF) has measured the profit before provisions of the Luxembourg banking sector at €2.482 million for the first half of 2019.

As of 30 June 2019, Luxembourg credit institutions recorded a profit before provisions of €2.482.1 million, representing a decrease of 15.5% compared to the same period the previous year. This deterioration of profitability resulted in part from a decrease in income (down 7.1%), which was largely due to a restructuring of the credit portfolio of one particular bank in the financial centre.

Half of credit institutions saw an increase in the interest margin as a result of the increase in business volume and the improvement in the average return on assets. Net fee and commission income increased by 3.6%, reflecting the positive development of asset management and custody businesses. However, only one-third of banks saw an increase in their net commission income. These were mainly establishments whose activity has strongly increased because of Brexit.

Overhead expenses continued to rise (up 10.7%). This increase was related to other overheads (+11.0%) as well as personnel costs (+10.4%). The size of the increase in general expenses was linked to the mobilisation of the human and technical resources needed to manage the banking activities transferred to Luxembourg in light of Brexit.

These developments ultimately led to a deterioration in the expense-to-income ratio, which rose from 53% to 59% at the end of the first half of 2019. This unfavourable trend reflects the difficulty banks have in maintaining profitability.