Credit: CSSF

Credit: CSSF

The Commission de Surveillance du Secteur Financier (CSSF) has measured the profit before provisions of the Luxembourg banking sector at €1.013 million for the first quarter of 2019.

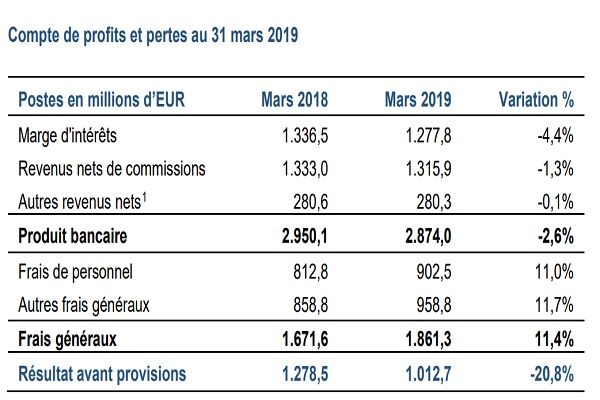

As of 31 March 2019, Luxembourg credit institutions recorded a profit before provisions of €1.012.7 million. In comparison with the previous year, earnings before provisions fell sharply by 20.8%. This deterioration of profitability resulted from both a decrease in income (-2.6%) and a rise in expenses (+11.4%).

On the income side, the interest margin fell by 4.4%. Excluding the negative effect of a portfolio restructuring with a bank, the interest margin would have increased significantly. This increase, which affected 57% of banks, is explained by the increase in the volume of activities as well as the improvement of the average return on assets. Despite the positive development of asset management and custody businesses on behalf of private and institutional clients, net fee and commission income decreased slightly (-1.3%).

Overhead expenses continued to increase sharply (+11.4%). This increase was related to other overheads (+11.7%) as well as to personnel costs (+11.0%). The sustained increase in general expenses continues to be the main cause of the negative evolution of profit before provisions for the majority of credit institutions. As a result, the profitability of banks, as expressed by the expense-to-income ratio, has deteriorated in annual comparison, from 57% to 65% at the end of the first quarter of 2019.