Credit: Screenshot of Carmignac presentation

Credit: Screenshot of Carmignac presentation

On Thursday 5 June 2025, Carmignac, an independent asset management firm with a subsidiary in Luxembourg, held a virtual event titled "Carmignac Outlook: From 'America First' to global financial anarchy", looking ahead to the second half (H2) of 2025.

The event featured Chief Economist Raphaël Gallardo and Investment Committee member Kevin Thozet, who highlighted current global economic uncertainty amid "Trumpism 2.0" policies while outlining a cautiously opportunistic investment roadmap for navigating these challenges.

Raphaël Gallardo painted a complex picture of global growth heading into H2 2025, with the following conclusions:

- Trumpism is negative for global growth. In relative terms, it redistributes growth from the United States to the rest of the world, for example China, through oil and dollar weakening, despite higher global term premia;

- the Bank of Japan's inflation complacency is adding impetus to the lower dollar and higher term premium trade;

- Europe, Japan and Canada will use newfound fiscal space to re-arm and de-risk their supply chains and digital infrastructure;

- China is likely to weaken its currency (CNY) by year-end to recreate fiscal space;

- India is one of the relative winners, as an energy importer less exposed to the US trade war and operating an introverted growth regime;

- emerging markets (excluding China) represent a sweet spot for oil importers and countries outside US President Donald Trump's tariff radar (e.g. Latin America and South Africa);

- Trump's actions are eroding the dollar's (USD) status as the global reserve currency. This erosion and the absence of a credible alternative imply a partial return to metalism (gold) and accelerated adoption of cryptocurrencies and stablecoins;

- NATO+ proxy wars with Iran and/or Russia are bound to escalate in H2, so oil upside optionality remains a valuable geopolitical hedge.

Kevin Thozet then presented Carmignac's preferred investment strategy, with key points as follows:

Multi-Assets:

- the first half of the year saw the US - the world's dominant reserve currency issuer - behaving like an emerging market, with a simultaneous declines in bond, dollar and equity indices. This serves as a reminder that active management has a utility function;

- Trump tactics, high long-dated bond yields and a reversal in long-term US dollar trends are concerning. However, these risks are becoming increasingly visible as reflected by investors' positioning. There is a path for risk assets to go higher, a thin path by which the "wall of worry" can be climbed.

Fixed Income:

- caution is warranted in sovereign debt markets: "the dog(e) barks more than it bites", with the US budget resembling a French budget and Germany spending at levels unseen in decades. Investors are demanding more for long-term lending;

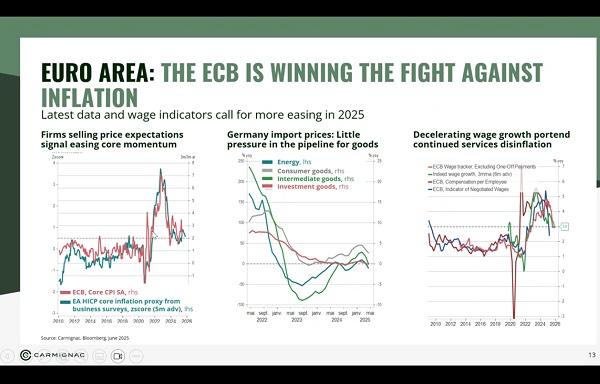

- short-term euro (EUR) debt is preferred, as disinflationary pressures allow the European Central Bank (ECB) to be proactive. USD five-year maturity bonds are also attractive due to Trumpism-induced measures requiring a reactive Federal Reserve (FED);

- inflation risk is underestimated, prompting a preference for real rates over nominal ones;

- yields in some credit markets offer an "island of certainty" amid broad uncertainty.

Currency:

- the "dollar smile", by which the USD performs well amid strong economic growth or recessionary fears, is shifting into a "dollar smirk";

- Carmignac employs a barbell strategy: favouring the euro and Japanese yen, which should benefit from further repatriation, alongside the Brazilian real and Chilean peso, whose trade balance should benefit from appetite for real assets.

Equity:

- "follow the money": significant capital expenditure in technology and rising demand for artificial intelligence (AI) are expected to benefit the companies most exposed to the sector. However, the starting point valuation matters for investment returns. Carmignac prefers hardware and hyperscalers, as well as Chinese firms which have demonstrated their capacity to turn from copycats to leaders;

- Europe and emerging market equities are undervalued, underowned and underestimated;

- the combination of long-lasting fiscal stimulus, monetary easing and attractive valuations bodes well for European equity markets. The rise of local currencies can act as a tailwind for some. Carmignac favours transactional companies with local-to-local business models, exporting companies with high pricing power and companies exposed to the domestic economy in Europe. In emerging markets, the focus is on domestic players in underpenetrated sectors, such as e-commerce and digital banking in Latin America.

The virtual event concluded a short Q&A session. There were about 40 virtual attendees present.