Credit: Quest / Questions.lu

Credit: Quest / Questions.lu

On Monday 10 February 2025, Quest Market Intelligence published the results of its spontaneous survey on the public pension system in Luxembourg.

The survey, which was conducted from 27 January to 1 February 2025, aimed to explore and quantify the understanding and perception of the public pension system among the resident population. The sample group for the survey consisted of 600 respondents and is regarded as representative of the resident population based on gender quotas, age groups and nationalities.

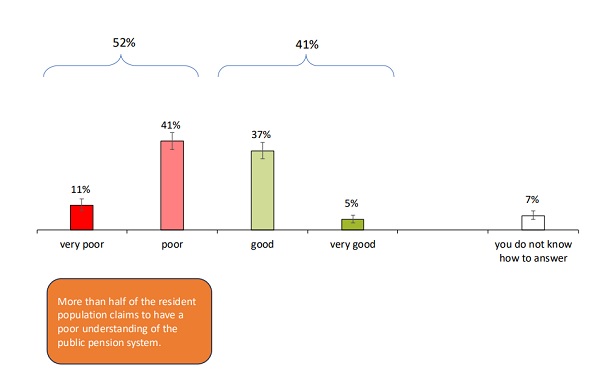

At a high level, the survey suggests a widespread lack of knowledge of Luxembourg’s public pension system, with more than 50% of residents reporting a poor level of understanding of how the system works, with particularly pronounced knowledge gaps among young people, women and foreign nationals.

According to the results, only four out of ten citizens know the contribution rate for employees, and only one in five knows that their personal contributions account for only one-third of the total contributions collected to fund their pension. These misperceptions are prevalent even among those who believe they understand the system well.

Amid ongoing debates about pension system reform in Luxembourg, the survey raises a fundamental question: How can an informed debate take place without better knowledge of how the system functions?

Despite this apparent lack of understanding, 66% of citizens who have heard about the debate recognise the need for revision of the system. A majority believe that the priority must be to ensure a sustainable pension system for future generations, placing other concerns, such as reducing inequalities or the economic growth debate into the background.

According to the survey, experts from competent public administrations are seen as the most credible voices to propose solutions, ahead of political and union representatives, with a preference for debate to be based on factual analysis rather than emotional or reductive arguments.

When participants of the survey were asked about which measures should be prioritised, they claimed to be in favour of the following:

- moderating the highest pensions (54%) (an option widely supported across all social groups);

- increasing contributions (30%);

- limiting early retirement before the legal retirement age (29%).

Other alternatives, such as raising the minimum retirement age (19%) and a general reduction of pension benefits (7%), received noticeably lower support, showing an aversion to changes which would affect benefits.

In conclusion, this survey highlighted a number of challenges relating to the direction which must be taken by those involved in the pension reform debates, as well as testing which options could successfully be utilised to enact any reform.

SM