Credit: STATEC; Housing Observatory

Credit: STATEC; Housing Observatory

On Wednesday 25 September 2024, Luxembourg's Housing Observatory and STATEC published their latest joint publication on the residential real estate market.

The main findings, as reported by Luxembourg's Ministry of Housing and Spatial Planning, were as follows:

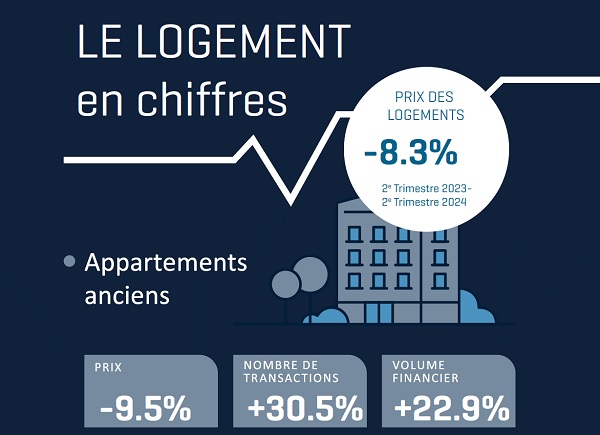

- activity on the residential real estate and land markets increased in the second quarter of 2024, after five consecutive quarters at historically low levels. The recovery in activity foreseen in the first quarter of 2024 was confirmed in the second quarter: respectively +30.5% and +33.8% for the number of sales of existing apartments and existing houses compared to the second quarter of 2023. In the segment of apartments under construction, on the other hand, activity has been struggling to recover, with -10.5% for the number of sales compared to the second quarter of 2023. The number of transactions thus remained four times lower than that of a "normal" second quarter with regards to apartments under construction;

- the slowdown in the decline in housing prices was confirmed in the second quarter of 2024. The hedonic index of housing sales prices provided by STATEC (including existing housing and housing under construction) even rose by 1.0% over one quarter. However, housing prices remained down over twelve months: -8.3% between the second quarter of 2023 and the second quarter of 2024;

- price trends in the different segments were heterogeneous over twelve months: -4.3% for apartments under construction (VEFA, sales in future state of completion); -9.5% for existing apartments; -9.9% for existing houses;

- the gradual stabilisation of prices was quite clear for existing apartments and existing houses: the fall in prices over twelve months was almost exclusively driven by the second half of 2023. In the apartments under construction segment, volatility appeared to dominate, the market being restricted and the composition effects quite strong.

The ministry noted that these price changes relate to notarial deeds registered in the second quarter of 2024, and therefore to sales agreements signed mostly before the end of April 2024.

Focusing on the latest trends in activity in the market for apartments under construction (VEFA), the ministry noted a slight recovery in activity in the second quarter of 2024, although it remained at historically low levels.

At the same time, the ministry noted that the share of "standard" transactions, those included in the calculation of apartment price indices, has fluctuated considerably.

Regarding the evolution of apartment prices and the number of transactions by surface area category, the ministry said that, despite the recent drop in apartment prices, which began in the second half of 2022, the index of apartments (existing and under construction) has seen an "impressive" evolution since 2015: +74.7% until the second quarter of 2024, which corresponds to an average annual change of +6.0%. Since the peak in mid-2022, apartment prices have however fallen by 12.3%. The apartment price index for the second quarter of 2024 thus returned to its mid-2021 level.

Nevertheless, the change in apartment prices was not uniform across different surface area categories. The prices of studios and small apartments, with a usable surface area below 50 m2, have increased more than those of apartments with a larger surface area.

Moreover, in the second quarter of 2024, advertised apartment rents increased as follows: +3.2% compared to the first quarter of 2024 and +3.3% compared to the second quarter of 2023. The annual increase was thus higher than that of consumer prices measured by the IPCN (+2.3%) over the same period. However, the ministry said caution should probably be exercised in interpreting this increase, since changes in advertised rents have remained quite volatile for several quarters.

The ministry also clarified that these are the rents requested by landlords for new rental contracts. The increase in rents during the lease was relatively moderate. It is currently significantly lower than inflation on consumer goods according to STATEC statistics: only +1.3% for the rental index between the second quarter of 2023 and the second quarter of 2024.