Credit: ING

Credit: ING

In its latest survey, ING has found that many Luxembourg residents have changed their daily saving and spending habits activities in the midst of the COVID-19 crisis.

ING conducted an International Survey to understand financial attitudes and behaviours of people in thirteen countries across Europe, both before and after the coronavirus lockdown. Just under 26,000 people took part, including 526 people aged 18 and over in Luxembourg.

The survey revealed that many interviewees self-reported actively changing their daily spending and saving activities. According to ING, the coronavirus pandemic and the accompanying lockdowns have thus changed people's attitudes when it comes to money, and Luxembourg is no exception. Among survey respondents, 55% of Luxembourg residents said they are spending less now than before the outbreak. Similalry, 41% felt that they were able to save more. This is even higher than in other European countries, where 44% of interviewees declared spending less and a third said that they are saving more.

On the other hand, some Luxembourg respondents reported having suffered a sharp decrease in income and/or the threat of such a loss. Both conditions help to explain why many said they were saving a bit more - putting something aside for an uncertain future.

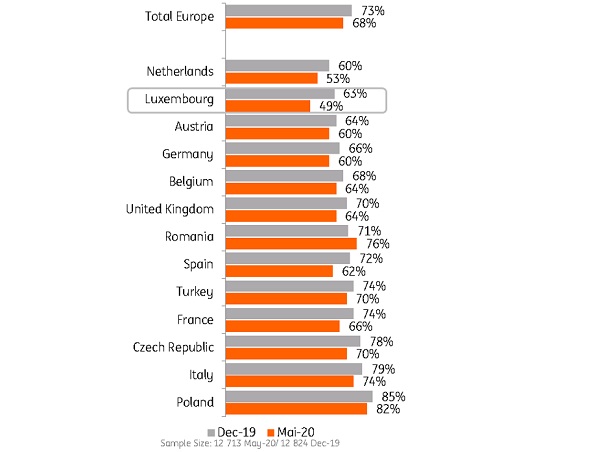

The self-reported changes in saving and spending may have led some to feel more comfortable with their level of savings. The ING survey showed a slight decrease in the percentage of Luxembourg residents who said they would need either much more or a little more in savings to feel that they are in a comfortable financial position (from 63% prior to coronavirus to 49% during confinement). This shift in savings comfort may be temporary, as lockdown seems to have reduced the ability of people to spend. Those who have been able to remain employed may feel they are saving more. However, ING recalled that its survey asked about perceptions rather than actual saving values. The same trend seen in Luxembourg was reflected at the European level.

Indeed, although survey respondents considered themselves to be saving more during lockdown, ING added that there is little evidence in self-reported savings figures that the share of respondents who have and those who do not have savings has changed noticeably. Prior to the coronavirus pandemic, in December 2019, 13% of residents confirmed that their household had no savings and, in May 2020, this figure dropped to 8%. Despite some variation, the survey showed that there does not seem to be any significant difference between the pre- and post-coronavirus saving habits for Luxembourg residents; figures have remained steady in the past eight years.

Ingrid Ballesca, Market Intelligence analyst at ING Luxembourg, confirmed: “We have been asking for years whether people have savings, and in Luxembourg the percentage of people who do not have any savings at all was consistently around 12%”. The coronavirus crisis does not seem to have changed that figure significantly.