On Friday 15 November 2024, Luxembourg's Commission de Surveillance du Secteur Financier (CSSF), the country's financial regulator, issued a press release calling for vigilance on greenwashing and green finance-

According to the CSSF, the market of sustainable financial products is growing rapidly, driven by an increased demand for environmentally friendly and socially responsible investments. This trend is a positive signal for the ecological transition and the fight against climate change. However, it is worth remembering that not all green or sustainability claims are necessarily true. As part of its mission relating to financial consumer protection, the Commission de Surveillance du Secteur Financier (CSSF) issued recommendations on its platform www.letzfin.lu

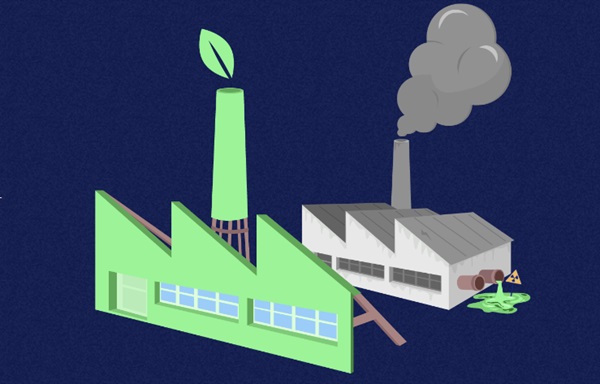

Greenwashing is a deceptive practice whereby certain companies present themselves as more sustainable than they actually are; this could mislead investors into believing that their money is being used for environmentally friendly purposes, although that is not always the case.

For Claude Marx, Director general of the CSSF, “investing sustainably is an important choice for investors, but also for the planet. But not everything that is painted green is necessarily green. We therefore encourage the public to remain vigilant, to question the promises made and to inquire about the transparency of financial products. Together, by casting a critical and informed eye on these products, we can contribute to a real green finance and a more environmentally friendly world.”

The CSSF has invited investors to think critically and not to rely blindly on labels and promises of sustainability.

The CSSF has confirmed a number of tips that help to assess the reliability of green financial products:

- What you see is not always what you get: the product name, even if it includes terms such as “ESG” (Environmental, Social, and Governance criteria), “green” or “sustainable”, does not necessarily warrant these features. It is essential to closely examine sustainability-related information and characteristics.

- Avoid vague promises: general commitments, without concrete proof, are often unreliable. Make sure that the given company or product has in place precise means to reach its goals. They must be described explicitly in the companies’ sustainability reports.

- Look for certified labels: these can be indicators of real commitment. But beware, some companies create their own certifications. Check their credibility and make sure that they are validated by independent organisations.

- Diversify your investments: as for any investment, diversifying your portfolio means reducing the risk of depending on a single company or sector. This allows for a better protection against greenwashing.

- Consult an expert adviser: do not hesitate to seek advice from advisers specialised in sustainable investment. They will help you to define your sustainability goals and distinguish genuine green opportunities from pretence.

More information is available on www.letzfin.lu/greenwashing