Credit: Capgemini Research Institute

Credit: Capgemini Research Institute

On Thursday 6 June 2024, the Capgemini Research Institute's World Wealth Report 2024 was presented in Luxembourg at the Sofitel Luxembourg Le Grand Ducal in Luxembourg-Gare.

The report revealed the number of high-net-worth individuals (HNWIs) and their wealth reached unprecedented levels in 2023, sparked by a rebound in the global economic outlook. According to the report, "global HNWI wealth expanded by 4.7% in 2023 reaching $86.8 trillion. Similarly, the HNWI population increased by 5.1% to 22.8 million globally and continues to grow despite market unpredictability. This upward trend offsets last year's decline and puts HNWI trends back on a growth trajectory".

Frédéric Robin, CEO and VP Capgemini Country Board Chairman in Luxembourg, explained that the report covers 71 countries and stated that it is the 28th such annual report which covers 3,100+ respondents.

Martine Klutz, Senior Business Executive, Capgemini Invent, explained that each year the report focuses on a different perspective and the respondents' expectations. She also clarified that there are three sizes of markets (assets us more than $30m; between $5 and $30 million; and between $1 and $5 million).

She explained that AI has been used this year to power behavioural finance and enhance personalisation and customer relationships.

In 2022, global stock markets performances declined; in 2023, there was a significant recovery (e.g. NASDAQ up 43%, S&P up 24.2% and the FTSE up 3.8%). HNWI wealth surpassed 2021 levels to reach new highs (86.8 (up from 83.0).

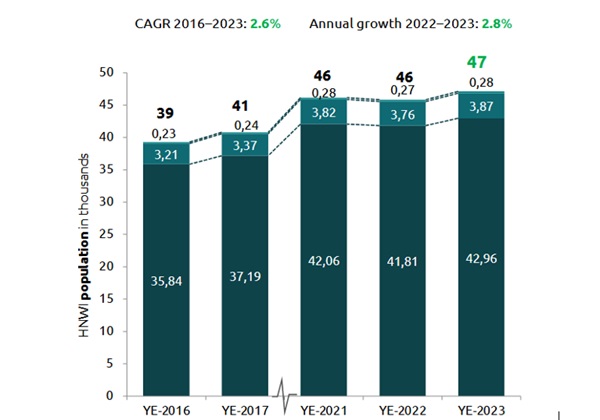

In Luxembourg, there are now 47,000 "wealthy people", with 280 (0.6%) in the $30 million bracket, 3,870 (8.2%) in the $5-$30 million bracket and 42,960 (91.2%) in the $1-$5 million bracket (up an average of 3% from 2022), with a total wealth of $139 billion, up from $135 billion in 2022.

In Luxembourg, two out of three Risk Managers said that their clients are showing more interest in reallocating towards growth assets; just one out of three want to go into private equity, driven by higher return and diversification methods. 50% of Risk Managers said that their clients are showing renewed interest in ESG-linked assets and their impact on society.

She also address the issue of wealth managers understanding their customers and wealth profiling, with 60% of customers' profiles being updated just annually in Luxembourg.

Laurent Barbazanges, Financial Services Market Segment Lead, Capgemini, took over for the next part of the presentation and addressed artificial intelligence (AI) and behavioural finance. He said that 50% of wealth management firms have already invested in AI and 73% plan to invest "big time" in AI over the next few years. He stated that the investment will go into three main areas: automating tasks, portfolio optimisation and client profiling. Together, they plan to elevate customer intimacy with intelligent capabilities to enhance client engagement.

He explained that AI is not "plug and play", that there is a lot of work to be done to integrate solutions. He gave some examples of AI-powered behavioural finance benefitting with a couple of brief case studies.

Martine Klutz then addressed ultra high net worth individuals (UHNWIs) who are more interested in growing their wealth, whereby the rest of HNWIs are more interested in preserving their wealth. In this context, Family Offices are either exclusively managing the wealth of one family or have a mutualised approach to multiple families' wealth. In Luxembourg, 50 out of 130 family offices are multi-family offices.

Methodology

The World Wealth Report 2024 covers 71 countries, accounting for more than 98% of global gross national income and 99% of world stock market capitalisation. The Capgemini 2024 Global HNW Insights Survey questioned 3,119 HNWIs including 1,300+ ultra HNWIs across 26 major wealth markets in North America, Latin America, Europe, Middle East and Asia-Pacific. The 2024 Wealth Management Executive Survey includes 75 responses across 12 markets, with representation from pure wealth management firms, universal banks, independent broker/dealer firms and family offices across North America, Europe and Asia-Pacific. The 2024 Relationship Manager Survey includes more than 750 responses across ten markets.

The Capgemini Research Institute is Capgemini's "in-house think-tank on all things digital and their impact across industries".

Frédéric Robin confirmed that Capgemini (under the Sogeti brand) has almost 600 staff in Luxembourg.