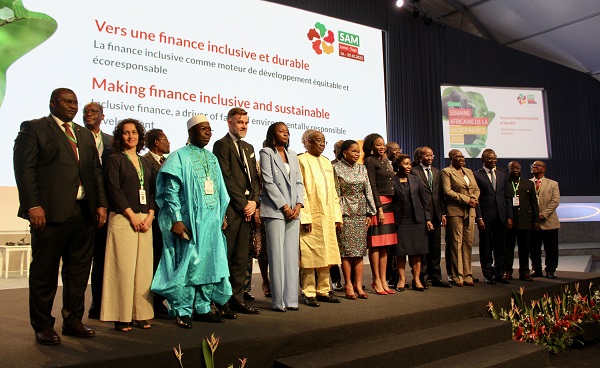

African Microfinance Week 2023 opening ceremony, featuring Franz Fayot, Luxembourg's Minister for Development Cooperation and Humanitarian Affairs;

Credit: MAEE

African Microfinance Week 2023 opening ceremony, featuring Franz Fayot, Luxembourg's Minister for Development Cooperation and Humanitarian Affairs;

Credit: MAEE

The African Microfinance Week (Semaine Africaine de la Microfinance - SAM), co-organised by Luxembourgish NGO ADA and funded by the Luxembourg Development Cooperation, is taking place in Lomé, Togo from Monday 16 to Friday 20 October 2023.

According to ADA, this biannual event strengthens the inclusive finance sector in Africa. This year's green inclusive finance theme aims to encourage investments in sustainable agricultural practices and solar-powered equipment through tailored savings, loans and insurance services.

ADA described financial services such as savings accounts, payment solutions and loans as "key pillars" of sustainable development, as they enable vulnerable households and micro businesses to make purchases to meet their daily needs, manage their cash, save and invest for the future and withstand financial shocks. Despite their potential to increase resilience and reduce socio-economic inequalities, these tailored services remain unavailable to large sections of the population, particularly in Africa, said the NGO.

The Luxembourg Government funds the African Microfinance Week, which is held in a different African country every two years. This year’s edition is currently taking place in Lomé, the capital of Togo, bringing together about 1,000 participants.

Franz Fayot, Minister for Development Cooperation and Humanitarian Affairs, commented: "Luxembourg’s impact investment sector is unique in terms of diversity of participants, which range from impact investment funds and private fintech companies to governmental agencies and NGOs. Through the African Microfinance Week, we are drawing on this expertise to strengthen the inclusive finance sector in Africa to support vulnerable people in saving for a better future and in starting a business. Ultimately, our goal is to contribute to improving their wellbeing and accelerate progress towards meeting the United Nation’s Sustainable Development Goals."

ADA added that while the inclusive finance sector mainly aims to reduce socio-economic vulnerability and inequality, it is no longer possible to support people in developing countries without taking into account the climate-change related risks they face. While Africa only emits between 2% and 3% of global greenhouse gases, it is the continent most threatened by climate change. According to ADA, inclusive finance can help affected communities adapt to climate change by facilitating investments in sustainable and climate-smart farming practices, energy-efficient equipment and housing and by providing appropriate financial and insurance services.

Laura Foschi, Executive Director of ADA, elaborated: "Reducing the carbon footprint of a very large number of micro and small companies through renewable energy or energy-efficient equipment can have a significant environmental impact. We are therefore striving to not just make finance inclusive but also sustainable to improve the quality of life of vulnerable people in a lasting manner, also for the benefit of future generations."

Organised by ADA in collaboration with the Microfinance African Institutions Network (MAIN), the week-long SAM event includes a two-day conference, an Investor Fair for impact investors looking to invest into microfinance institutions and an Innovators' Village showcasing the latest inclusive finance products and services.