Professor Christos Koulovatianos, the Head of the Department of Finance at the University of Luxembourg;

Credit: Otilia Dragan/Chronicle.lu

Professor Christos Koulovatianos, the Head of the Department of Finance at the University of Luxembourg;

Credit: Otilia Dragan/Chronicle.lu

On the evening of Monday 23 October 2023, the Head of the Department of Finance at the University of Luxembourg, Professor Christos Koulovatianos, held a conference at the Abbaye de Neumünster in Luxembourg-Grund, entitled “Housing Markets in Luxembourg, Prospects and Challenges”.

The organisers noted that Luxembourg is one of the countries with the highest household leveraging on private debt and mortgage loans. Over an extended period, there has been an increasing disparity between renting expenses and the prices of homes. This imbalance exposes the entire economy to external disturbances, including energy-related shocks. Given that real estate plays a significant role in the financial portfolios of households, businesses and banks, there is a systemic risk associated with the potential formation and subsequent bursting of a housing bubble. A sudden decline in housing prices has the potential to spark a widespread economic crisis. This lecture covered the concepts and principles for identifying these vulnerabilities and influencing housing cost dynamics through policy measures.

The two main questions addressed at this lecture were whether housing will ever be affordable in Luxembourg and whether there is a risk of crisis in the Grand Duchy due to its housing market situation.

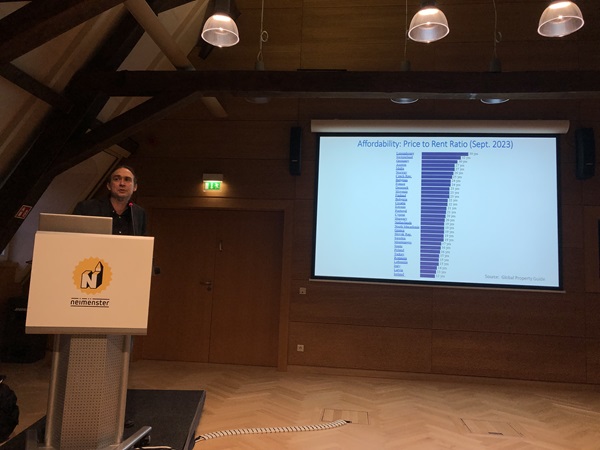

Professor Koulovatianos stressed that young Luxembourgers growing up in the country find themselves increasingly unable to live in the Grand Duchy and move to the border areas of neighbouring countries. He added that the raw data highlights what inhabitants of the country can “feel” living here. Luxembourg is a champion of unaffordability concerning housing - the price-to-rent ratio in Luxembourg is high (due to the strong demand for housing and limited supply), with a return on investment of 39 years as of September 2023.

In Luxembourg, house prices and rents went up because of inflation, particularly since the 2007-2010 banking crisis, which brought the average house prices up across Europe. In the Grand Duchy, while it might seem “normal” that the price to income and price to rent go up faster and are more intense than in the rest of the EU, due to immigration, Professor Koulovatianos emphasised that this is a reason for concern on which policy makers should keep an eye and consider.

Luxembourg is quite special for its status (immigrants continuously come in, capital and jobs increase, etc.), but the housing market could be 60% overvalued, according to standard methodologies.

University of Luxembourg studies for this year have predicted a house price drop of 16.9%. While they have the technology to package information that they see they also have to try to reconstruct “unobservables”. The market shifts are influenced by many different variables, among which are global issues such as wars. The housing market can be affected by changes in supply and demand. In times of war, housing construction may slow down, leading to a reduced supply of new homes (which is currently the case). Additionally, people may delay buying homes due to economic uncertainty, thus affecting demand. Housing prices can be influenced by economic factors such as inflation and interest rates. High inflation can drive up the cost of living and impact the prices of goods and services, including housing. Changes in interest rates, driven by government policy responses to the war, can impact mortgage rates. Higher rates then make it more expensive to finance a home purchase. “If the war progresses too fast and goes too far, we could have extremely high prices which will push interest rates higher,” said Professor Koulovatianos, referring to the current Israel-Palestinian conflict. “Once the war starts, what is needed is a long-term re-introduction of housing and credit markets to healthy market forces.”

Luxembourg’s economy is difficult to predict, according to Professor Koulovatianos, due to the shifts in inflow of foreign capital and the immigration rate. He expressed optimism at the situation, however, due to the country’s safe investment environment owing to its “very good political stability”.

The conference’s takeaways were that low interest rates have put the real estate market in an exposure regime, whereby sudden interest rate rises are a likely threat. Professor Koulovatianos noted that individuals can exercise caution by buying fixed-interest rates and avoiding variable mortgage rates. He added that housing could become affordable in the country if the bubble “deflates” slowly instead of “bursting”.