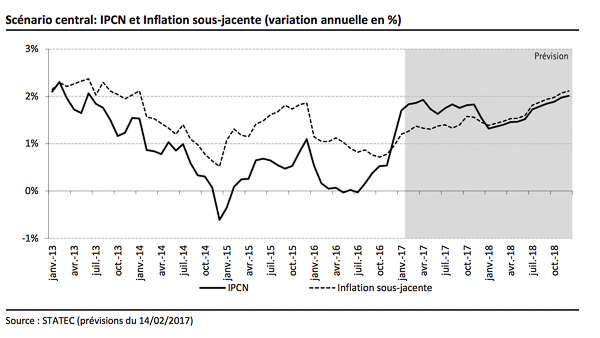

The rate is expected to rise substantailly against 2016's 0.3% rate due, in part, to rising oil prices with the central scenario predicated on the assumption that the price of Brent crude oil and the exchange rate will remain at current levels, and a 10% increase in the petroleum product index of 10% for 2017 compared to 2016. Thus, petroleum products are expected to contribute substantialy, by 0.5%, to the rise in overall inflation.

According to the report published today, the inflation rate rebounded sharply, from zero in the summer of 2016 to 1.3% in December, and 1.7% in January this year. It is expected to remain relatively high over the coming quarters.

Other causes for the upswing can be found in the rise in underlying inflation, which is also expected to gradually increase.

On the basis of these forecasts, the next automatic salaries adjustment should take place next year.